Wednesday marked delivery report day for Tesla and Rivian, as both electric vehicle makers posted figures reflecting ongoing pressure from waning demand and intensifying competition. Offering fresh insight and key takeaways to help assess the EV market is a new note from Goldman Sachs analysts led by Mark Delaney.

Tesla reported 2Q25 deliveries of 384k vehicles, up 14% quarter-over-quarter but down 13% year-over-year. Production totaled 410k, flat versus the previous year. The Model 3/Y made up most of the deliveries at 374k (+15% QoQ, -12% YoY), while other models (S/X/Cybertruck) fell to 10k (-19% QoQ, -52% YoY). Lease penetration fell 2%, from 4% in the first quarter of the year.

Deliveries missed Visible Alpha Consensus Data of 394k, but beat Goldman’s forecast of 365k. Delivery boosts came from the U.S., Europe, and other markets, while China volumes were mainly in line with expectations.

Regionally, YoY sales declined:

-

U.S.: down mid-teens

-

Europe: down 30%

-

China: down mid-single digits

The declines across the U.S. and Europe were primarily attributed to deteriorating consumer sentiment, driven by an information war waged by far-left NGOs, progressive lawmakers, and left-leaning corporate media against Elon Musk’s gov’t efforts—such as running DOGE—to expose corruption and fraud within the bloated U.S. government. In China, competition from BYD and other EV makers played a much larger role in softening sales.

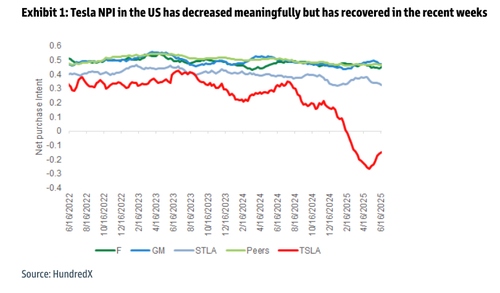

The analysts provided HundredX’s net purchase intent scores for Tesla that began to slide when Musk began ramping up DOGE operations earlier this year. With Musk’s exit from DOGE, there appears to be a meaningful NPI rebound; the shape of the recovery is not yet determined.

Delaney listed five key Tesla items for clients to focus on:

1) Outlook for vehicle deliveries

We think that one debate in the market from here will be on the trajectory of Tesla’s vehicle deliveries. We believe one key factor to monitor will be the launch of Tesla’s new model(s) including the timing of these launches, and the degree that the features/costs of new models are differentiated enough vs. what Tesla currently provides to drive material growth. Tesla had been aiming to launch a new lower cost model in 1H25 per comments on its 1Q earnings call, but so far this has not occurred to our knowledge. While we expect new model(s) to help with growth, Tesla’s management team noted that using its existing production lines would limit how differentiated new models may be in terms of form factor (and media reports have described the lower cost model as a variant of the Model Y). In terms of headwinds, IRA consumer EV credits could be eliminated later this year under the current ‘OBBB’ that passed the U.S. Senate, Tesla is facing significant EV competition in China, and Tesla’s consumer brand scores per surveys (HundredX and Morning Consult) have deteriorated in North America and Europe.

We also expect investors to question whether a degree of the 2Q upside was pull-in ahead of the potential end to IRA EV consumer credits.

Given the better 2Q delivery results, we raise our 2025 delivery forecast to 1.594 mn (down 11% yoy) from 1.575 mn (down 12% yoy) prior. Our 2026/2027 estimates are unchanged at 1.865 mn/2.150 mn. Our estimates for 2025/2026/2026 are below Visible Alpha consensus at 1.647 mn/1.995 mn/2.259 mn.

2) Automotive margins

We expect Tesla’s automotive non-GAAP gross margin excluding regulatory credits to remain a key focus for investors, and we are now modeling the automotive non-GAAP gross margin to be 12.7% in 2Q, compared to our prior estimate of 12.5% and up from 12.5% in 1Q25, with the increase driven by higher volumes. However, we expect pricing and to a lesser extent tariffs to remain headwinds to margins.

3) Progress with robotaxis and FSD

We believe investors will be looking for data on the performance of Tesla’s robotaxi service in Austin, and what it would take to expand (both within Austin and to other locations). As we discussed previously, most of the rider reactions from the early access individuals Tesla invited were positive, though there have been some instances of errors for the robotaxis based on media reports and videos posted by riders on X which has led to NHTSA requesting information from Tesla regarding these incidents (such as a car driving in the turn lane intended for cars going the other direction) per media reports. In our view, the way that Tesla has implemented the roll-out in Austin (e.g. with a local version of the software, geofencing, and a safety observer), coupled with the early performance challenges, suggests the ramp in the near-term will be slow, although we see a bigger market opportunity in the long-term for AVs.

We also think investors will look to understand progress with FSD for personal vehicles, and when FSD can be eyes-off for consumers. We continue to expect Tesla to limit unsupervised FSD for consumers at least in a wide domain for some time given the manner in which the company is implementing robotaxis and based on FSD performance data. However, we believe Tesla could allow for situational eyes-off operation in select situations (e.g. on highways in good weather) in the next few years, and we think this could help to improve FSD monetization.

4) Growth in other segments, including Services and Energy

Tesla deployed 9.6 GWh of energy storage products in 2Q25 vs 2Q24 at 9.4 GWh and 1Q25 at 10.4 GWh. Recall Tesla has previously noted that given the large-scale nature of some projects, deployments by quarter could be lumpy. We continue to assume Tesla’s Energy deployment growth will be more measured, and its margin could be pressured, by tariffs on LFP batteries that in the past were sourced from China. Tesla announced in June on X that its LFP factory in the U.S. is nearly ready to begin production.

5) Progress with Optimus and expectations on ramp timing

Recall on the 1Q call Tesla had commented that it remained on track for Optimus builds on its Fremont pilot production line in 2025. Additionally, management commented that it expected to have thousands of Optimus robots working in Tesla factories and doing useful work by the end of this year and to build a total of 10K robots in 2025. However, the head of Tesla’s Optimus business, Milan Kovac, recently departed (as discussed in media reports). A media report also suggested that Tesla has currently paused Optimus production.

The analysts provided color on price targets and estimates on the stock:

We raise our 2025 EPS estimate including SBC to $1.15 from $1.10 reflecting the better 2Q auto results, and maintain our 2026/2027 EPS estimates of $2.05/$3.00. Our CY25/26/27 non-GAAP EPS estimates (ex. SBC) are now $1.60/$2.50/$3.45.

We raise our 12-month price target to $315 from $285, which is based on 120X (unchanged) applied to our updated Q5-Q8E EPS estimate including SBC.

We remain Neutral rated on the stock. While we expect Tesla will face difficult fundamental conditions for its auto business over the near to medium term, we expect Tesla’s earnings growth to improve over the longer-term due in part to increased profits from FSD/robotaxis (although we have a more balanced view of Tesla’s monetization potential than we believe the company is targeting), and due in part to new product launches.

Key downside risks to our view relate to potentially larger vehicle price reductions than we expect, increased competition in EVs, a larger than expected tariff impact, slower EV demand, delays with products/capabilities like FSD/4680, key person risk, the internal control environment, margins, and operational risks associated with Tesla’s high degree of vertical integration. Upside risks include faster EV adoption and/or share gain by Tesla, a stronger macroeconomic environment for new vehicle sales more generally, earlier new product launches than we expect, an earlier/larger impact from AI enabled products (e.g., FSD, Optimus and robotaxis), and a smaller than expected tariff impact than we currently anticipate.

Next was Rivian, the analysts noted a sharp fall in 2Q25 deliveries…

Rivian reported 2Q25 deliveries of 10,661 (up 23% qoq and down 23% yoy), which was about in line with Visible Alpha consensus of 10.7K and slightly below GSe at 11.0K. The company produced 5,979 vehicles (down 59% qoq and down 38% yoy).

The company commented that production was limited during 2Q in preparation for the model year 2026 vehicle launches that it expects later in July. Additionally, per the release, Rivian reaffirmed its 2025 delivery guidance of 40-46K. Separately, the company commented that it received a $1 bn equity investment from VW at the end of the quarter following its second quarter of gross profit in 1Q25 (in line with its previous commentary).

We modestly adjust our 2025 delivery estimate to 42.5K from 43K, and maintain our 2026/2027 estimates of 55K/92K. Our 2025/26/27 EPS estimates including SBC are unchanged at -$3.00/-$3.10/-$2.75. Our EPS estimates excluding SBC remain -$2.35/-$2.40/-$2.00.

We maintain our Neutral rating on the stock. Our 12-month price target remains $14, and is still based on 2.5X EV/Q5-Q8 revenue. Key upside/downside risks to our view relate to EV adoption, volumes, margins (including the ability to grow in software & digital services), Rivian’s high degree of vertical integration, cash burn, and the supply chain.

The weak EV market may also be partly driven by elevated borrowing costs for auto loans. The good news: interest rate cuts could begin as early as September. At the same time, President Trump’s proposed tax and spending package would eliminate federal EV tax credits for purchases or leases made after September 30. That sets the stage for a potential final leg of the EV price war—one that may leave only the strongest players standing. At this point, Tesla appears to be alpha.

Tyler Durden

Thu, 07/03/2025 – 10:50

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://zerohedge.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.