Efforts to curb exploitative litigation through conservative tax provisions face criticism for potentially shielding corporate giants rather than advancing conservative ideals.

At a Glance

- A new provision in a major GOP tax bill would impose a 41% tax on third-party litigation funding.

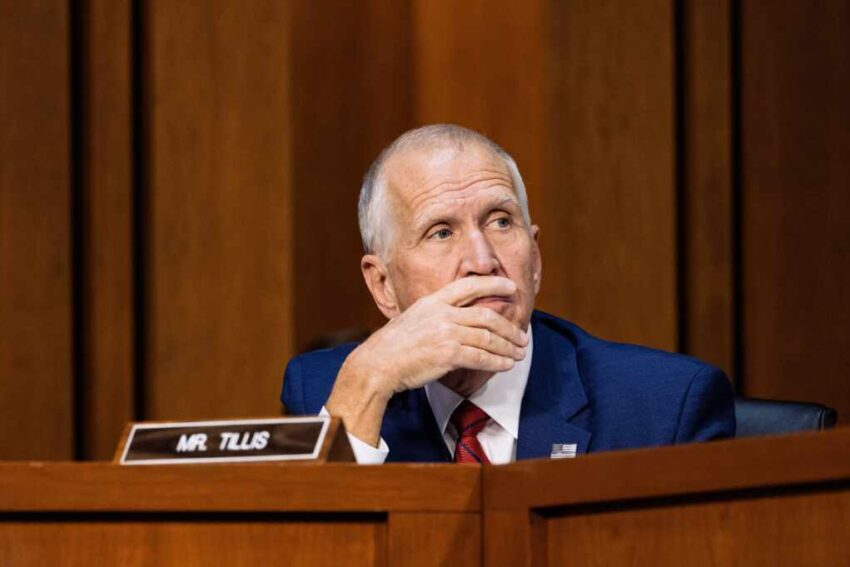

- The measure, sponsored by Sen. Thom Tillis, is being fiercely opposed by some grassroots conservatives and populist Republicans.

- Critics like Rep. Anna Paulina Luna argue the bill is a “massive gift to Big Pharma, Big Tech, and woke corporations.”

- The debate has created a rift, pitting pro-business Republicans against those who see litigation funding as a key tool for individuals to fight powerful interests.

A “Gift to Woke Corporations”?

A major internal battle has erupted within the Republican party over a provision slipped into a must-pass legislative package that would tax third-party litigation funding. The measure, known as the “Tackling Predatory Litigation Funding Act,” is being slammed by a vocal group of conservatives as a giveaway to powerful corporations that will harm ordinary Americans’ ability to seek justice in court.

“Senator Thom Tillis just slipped a massive gift to Big Pharma, Big Tech, and woke corporations into the ‘Big Beautiful Bill,’” Rep. Anna Paulina Luna (R-FL) said in a statement reported by the Washington Examiner. “His anti-litigation finance plan… slaps a 41% tax on the very tool that helps ordinary Americans fight back in court.”

The Battle Over Litigation Funding

Third-party litigation funding is a practice where an outside investor covers the costs of a lawsuit in exchange for a share of the potential settlement. Proponents of the new tax, like Sen. Thom Tillis (R-NC), argue it is necessary to stop “profit-driven investors” from fueling frivolous lawsuits that clog the courts.

However, a growing number of conservatives disagree. They argue that litigation funding is a vital free-market tool that allows individuals, whistleblowers, and small businesses to take on powerful and wealthy opponents they could never afford to fight otherwise. As noted by the Conservative Review, this financial tool has been used to fund a wide range of cases, from intellectual property disputes to lawsuits brought by victims of terrorism against state sponsors of terror.

A Conservative Divide

The debate has created strange bedfellows and a deep rift on the right. Grassroots groups like the Tea Party Patriots have come out against the tax, arguing it will make it harder to hold powerful entities accountable. They fear the provision would not only shield corporations but could also undermine conservative-backed lawsuits against organizations like Planned Parenthood, which often rely on outside funding.

Rep. Luna summarized the opposition’s view bluntly: “This bill protects elites and punishes whistleblowers, inventors, and retirees. It’s a corporate shield dressed up as reform.” The intra-party fight highlights the ongoing struggle between the GOP’s traditional pro-business wing and its more populist, anti-establishment faction. As the larger bill moves through Congress, this contentious provision threatens to derail a key piece of the Trump administration’s legislative agenda.

Click this link for the original source of this article.

Author: Editor

This content is courtesy of, and owned and copyrighted by, https://republicanpost.net and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.