The Fed’s favorite inflation indicator – Core PCE – came in hotter than expected in May, rising 0.2% MoM (+0.1% MoM exp) and +2.7% YoY (+2.6% YoY exp)…

Source: Bloomberg

Not exactly the hyped-up inflationary surge the tariff fearmongers had hoped for as non-durable goods price show modest increase MoM…

Source: Bloomberg

Headline PCE rose 0.1% MoM (as expected) and the YoY change ticked up to +2.3% YoY…

Source: Bloomberg

Non-durable goods flipped from deflationary to inflationary (modestly) in May…

Source: Bloomberg

SuperCore PCE inched higher on a YoY basis (from +3.07% to +3.12% YoY)…

Source: Bloomberg

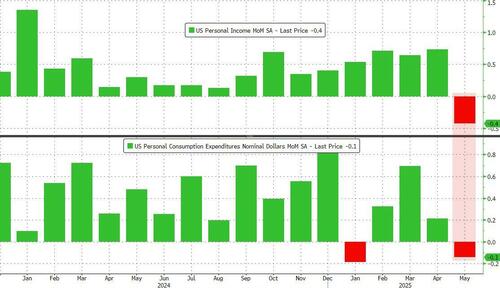

Both personal income and spending tumbled in May (the former by the most since Sept 2021)…

Source: Bloomberg

On the income side, govt workers saw wage growth slow:

-

Private worker wages rose 4.6% yoy, up from 4.4% and the highest since Dec 24

-

Govt worker wages rose 5.2%, down from 5.3% and lowest since Oct 22

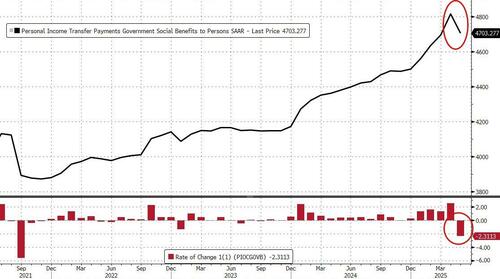

But, Income’s drop was mainly due to a plunge in government handouts…

Source: Bloomberg

With the biggest drop in social security benefit handouts ever as DOGE killed all the payments to those ‘dead’ or extremely old people…

Source: Bloomberg

The savings rate dropped significantly to 4.5% of DPI…

Source: Bloomberg

Is there enough here to nudge The Fed towards a cut? Or do we keep waiting for the ‘lagged’ effect of tariffs to finally show up in prices?

This is the ‘transitory’ no inflationary impact period!

Tyler Durden

Fri, 06/27/2025 – 08:47

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://zerohedge.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.

_0.jpg?itok=s2towCbS)

_0.jpg?itok=Ylq_rojA)

_0.jpg?itok=10wWhp_4)

_0.jpg?itok=ji2LQPsb)