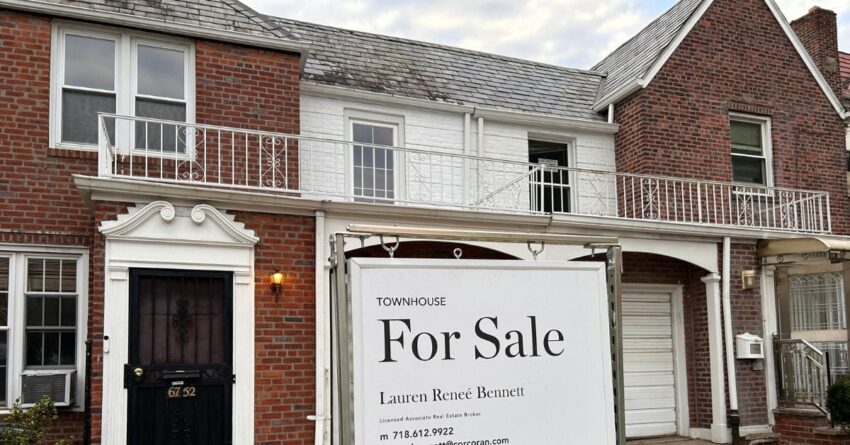

A real estate analyst has noticed an “alarming” decline in investor demand in the United States housing market, according to reports. Knewz.com has learned that the housing markets affected by fewer investor purchases are witnessing rapidly rising housing inventory and supply, thus resulting in lower home values on a month-to-month basis in many markets.

Home values are reportedly falling month-over-month in more than 60% of U.S. counties. According to Nick Gerli, the CEO of the Reventure app, the decline in housing prices is so widespread that it can only be compared to the 2008 housing market crash or the 2022 mortgage rate spike. “More than half the country is now officially in month-over-month declines, indicating that the housing downturn is spreading,” Gerli wrote on X. “We’ll have to see if this lasts into the future, and if it turns into a sustained correction like 2008 or is a blip like 2022. But given the trajectory of listings and inventory, it seems like more value declines are coming,” he added.

According to the real estate company Zillow, monthly home values have already dropped in 27 out of 50 states this year. Since investor purchases play a significant role in determining housing prices in certain markets, lower investor demand can make the situation quite challenging for sellers. “The collapse in investor demand in the U.S. Housing Market is alarming… In a market like Atlanta, investors are buying 65% fewer homes than they did at the peak of the pandemic,” Gerli wrote of the recent housing trend on X. The real estate analyst further noted that outside Atlanta, investors were abandoning other markets including Jacksonville, Phoenix, Charlotte, Nashville, Miami and Denver. Jacksonville experienced a 63% decline in investor purchases, while Charlotte and Nashville saw declines of 61% and 59%, respectively.

“Home values in many of these markets boomed during the pandemic, as a result of the huge spike in investor demand. So what happens to home values when this demand goes away, and when these investors sell? I believe we’re starting to see the answer,” Gerli commented. Kevin Thompson, the CEO of 9i Capital Group, also noted this “alarming” trend in Fort Worth, Texas: “There were multiple homes purchased during the new build process by an investment group, and they have been left vacant for months… We are starting to see renters come back in as of now, but those places were vacant for at least six months which can be a large cash outlay for those companies. They were even trying to sell the properties outright, yet the market is just so tight at the moment,” he said. Gerli further explained that “the issue with investors in the housing market is that they tend to ‘amplify’ whatever the current market trends are.”

“If there is a bubble, investors will make the bubble bigger, bringing in external capital into a local housing market that should be dependent on local buyers. Meanwhile, in a crash or downturn, investors tend to make the situation worse. Leaving the market in droves before the crash gets worse,” Gerli said. However, Michael Ryan, a finance expert and the founder of MichaelRyanMoney.com, begs to differ and refuses to call the current situation “alarming.” Said Ryan, “When I see headlines calling this ‘alarming,’ I’m like… alarming for who exactly? For the investment firms that got caught holding overpriced assets when the music stopped? Or for my oldest son, who might finally be able to afford a home? … It’s not a crisis, it’s a housing market correction that’s been a long time coming. And frankly, it can’t happen fast enough.”

The post Housing Market Shows ‘Alarming’ Trend appeared first on Knewz.

Click this link for the original source of this article.

Author: Samyarup Chowdhury

This content is courtesy of, and owned and copyrighted by, https://knewz.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.