I was not a fan of George W. Bush’s economic policy.

But he had one idea – personal retirement accounts – that would have been great news for the country.

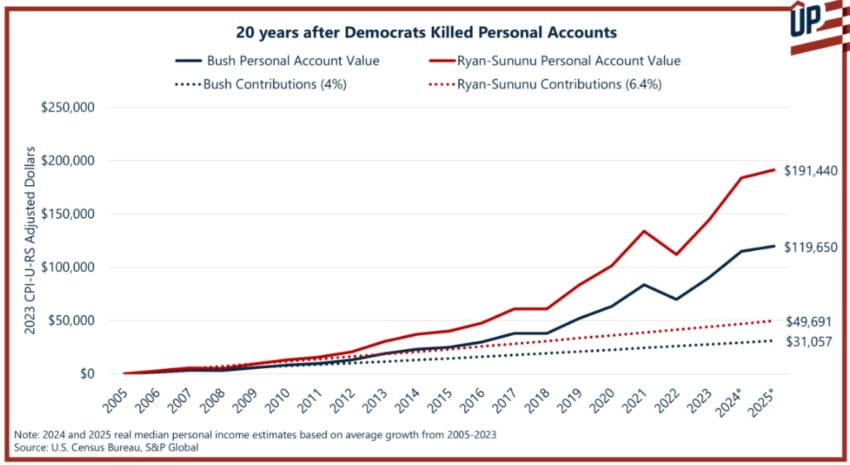

The Committee to Unleash Prosperity has calculated the nest eggs that average workers would have today if either Bush’s plan or the Ryan-Sununu plan had been enacted.

Sadly, since we just learned that the inflation-adjusted cash-flow deficit for Social Security is $65.8 trillion, we have a very grim comparison.

- We could have had a pro-growth system based on real savings.

- Instead, we have a Ponzi Scheme based on taxes, spending, and debt.

The above chart, however, is only part of the story. In addition to letting workers shift payroll taxes to personal accounts, there were also discussions during the Bush years about reforming the program to restrain spending so there was no longer a giant unfunded liability.

Andrew Biggs of the American Enterprise Institute (and former Deputy Commissioner of the Social Security Administration) authored a new report looking at what would have happened if workers had been allowed to have personal retirement accounts while the program was changed to slow the growth of benefits for people with above-average income.

Here are some excerpts that summarize his study.

Twenty years ago, in winter and spring 2005, President George W. Bush embarked on a nationwide tour to promote his plans for Social Security reform, which included slowing the growth of benefits for middle- and high-earning individuals and establishing voluntary personal accounts in which workers could invest part of their payroll taxes. Bush’s changes to traditional Social Security benefits, termed “progressive price indexing,” would have addressed about two-thirds of the program’s long-term funding gap. …I model total Social Security benefits for individuals retiring in 2025, incorporating Bush’s progressive benefit changes and personal account balances based on investment market returns. Workers with very low, low, and middle earnings would have received total Social Security benefits 3–8 percent above those scheduled in current law, while high-earning employees and those earning the maximum taxable wage and above would have received benefits 2–4 percent below scheduled levels.

And here’s the key table from the report. As you can see, lower-income and middle-class workers retiring today would be enjoying more retirement income.

And ordinary workers retiring in the future would benefit even more, with 11 percent-26 percent more retirement income.

For what it’s worth, I think the assumptions in the report (only 31 percent of personal accounts would be invested in stocks at age 65) were too cautious, so I think it’s quite possible everyone would wind up better off with the Bush approach.

But even if we stick with Biggs’ assumptions, it should be clear that the country would be much better off today if Bush’s approach had been adopted two decades ago.

What a huge missed opportunity. We had the economic version of a lay-up, and Congress didn’t even take a shot.

P.S. We also had a chance to reform Social Security during the 1990s. Unfortunately, the fight over impeaching Bill Clinton derailed that effort, leading me to write that his “sexual dalliance” with Monica Lewinsky “was the most expensive you-know-what in world history.”

P.P.S. Mike Tanner produced a report back in 2012 showing that workers would have been better off with personal retirement accounts even if they retired right after the 2008 financial crisis. The bottom line is that investing in financial markets is far safer than trusting empty promises from callow politicians.

P.P.P.S. For those who think personal retirement accounts are risky and untested, please see what I’ve written about Australia, Chile, Switzerland, Hong Kong, Netherlands, the Faroe Islands, Denmark, Israel, and Sweden.

———

Image credit: geralt | Pixabay License.

Click this link for the original source of this article.

Author: Dan Mitchell

This content is courtesy of, and owned and copyrighted by, https://freedomandprosperity.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.