A major theme of my daily columns is that economic freedom is a universal recipe for faster growth and better economic performance.

But the flip side is that statist policies inevitably lead to less prosperity.

And these statements are true in every part of the world.

Today we’re going to focus on Mauritius, an island nation in the Indian Ocean, more than 1,000 miles from the east coast of Africa.

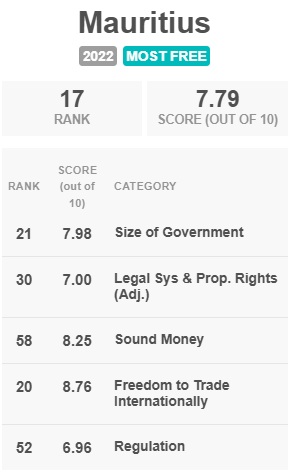

What makes Mauritius noteworthy is that it has a relatively high level of economic freedom, usually ranking in the top 20.

Indeed, I shared a table last year showing that it has the most pro-market policies of any African nation.

Has this approach worked for Mauritius?

According to the Maddison database, the answer is yes.

Here’s a comparison of per-capita GDP for Mauritius, India, and Madagascar (I include India because that the country with the most similar people and culture and I include Madagascar because it is geographically closest).

It goes without saying that Mauritius has outperformed the other two nations because it has much more economic liberty, ranking #17 in the world, much better than India (#84) or Madagascar (#116).

Given the way it has out-paced the others, we can add it to the Anti-Convergence Club.

But the purpose of today’s column is not to shower Mauritius with uncritical praise.

The country may be slipping. Back in 2018 and 2019, it ranked #9 for economic liberty compared to #17 today. And it didn’t fall because other nations got better. It’s economic liberty score has dropped in absolute terms, from 8.18 to 7.79 (on a 0-10 scale).

The Economist recently wrote about Mauritius hitting a bump in the road. Here are some excerpts.

…in 1968…it was as poor as the average African country. A Nobel economics laureate reckoned the “outlook for peaceful development” was “poor”… Yet today it has Africa’s second-highest GDP per person at around $12,000, eight times the African average, behind only tiny Seychelles. …But trouble is in the air. …Under the previous government handouts became the norm: cash for new mothers; phone credit for 18- to 25-year-olds; an obligation for firms to pay an extra end-of-year bonus. The ratio of public debt to GDP this year will be 90%. The budget deficit is expected to widen to 6.6% of GDP. A local investor notes that the former finance minister was educated in France and “it was as if he was running the French state”.

This probably won’t surprise readers, but the “previous government” that made all the mistakes was headed by prime ministers from the Militant Socialist Party.

No wonder things have gone downhill.

Since I’m a fiscal wonk, I’ll close out today’s column with a very worrisome chart based on IMF data.

As you can see, there’s been a substantial increase in both the spending burden and tax burden in Mauritius.

The good news is that government is still not as big as it is in the United States. And it’s nowhere close to having a bloated public sector like France.

But the trend is not encouraging. If Mauritius wants to escape the “middle-income trap,” it needs some dramatic reform – including a spending cap.

———

Image credit: Arne Müseler | CC BY-SA 3.0 DE.

Click this link for the original source of this article.

Author: Dan Mitchell

This content is courtesy of, and owned and copyrighted by, https://freedomandprosperity.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.