Authored by Mike Shedlock via MishTalk.com,

The Fed does not “predict”, but its GDP projections say “yes”…

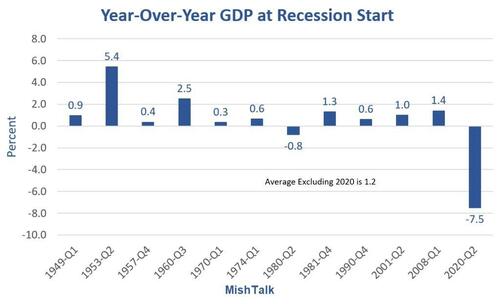

Year-over-year GDP data from the BEA, chart by Mish.

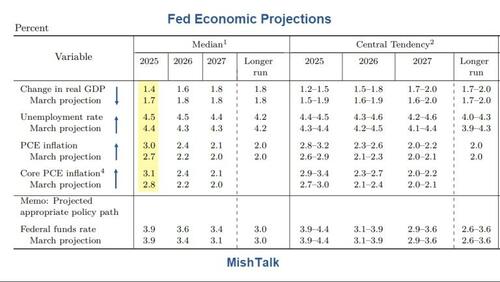

The Fed’s Summary of Economic Projections (SEP),shows its median fourth-quarter year-over GDP projection was 1.4 percent.

“Projections of change in real gross domestic product (GDP) and projections for both measures of inflation are percent changes from the fourth quarter of the previous year to the fourth quarter of the year indicated.”

In March, the Fed’s GDP projection for 2024 was 1.7 percent. It’s now 1.4 percent.

At first glance, 1.4 percent does not suggest recession. A closer look says otherwise.

Since 1948, there have been 12 recessions. And since 1948 there have only been three false positive instances in which year-over-year GDP declined from above 3.0 percent to 1.4 percent or lower in which there was not a recession.

Year-Over-Year GDP at Recession Start

Of the 12 recessions since 1948, 10 of them started with year-over-year GDP in positive territory.

Excluding the Covid collapse, the average of 11 instances has year-over-year GDP at the start of recession at 1.2 percent.

Predict may not be the correct word, but the Fed’s economic projections strongly suggest recession.

Fed’s Counterproductive Actions

The Fed’s battles to prevent recessions have created economic bubbles of increasing amplitude over time.

Stock market and housing prices are beyond insane and the consensus bet appears to be that the Fed will act to keep them that way.

Fed Projects Higher Unemployment and Higher Inflation Citing Tariffs

Yesterday, I noted Fed Projects Higher Unemployment and Higher Inflation Citing Tariffs

The Fed’s outlook has soured vs its March forecast. “We expect a meaningful rise in inflation in the coming months,” said Powell.

Regarding jobs, Powell said the labor force, participation rate, wages are all at “healthy levels”.

“You can see perhaps a very slow cooling but nothing that troubling at this time.”

Apparently Powell believes BLS statistics. I don’t. He does not see the train coming down the tracks.

Click on the preceding link for more Fed projections.

I commented “There’s a very good chance unemployment arrests the Fed’s expected inflation. But that assumes I am correct on weakening jobs.“

Also short-term is one thing and long-term another.

The Fed has destroyed housing with inept QE to the moon, and Congress is about to whip up inflation with Trump’s One Big Beautiful Act. Finally, Trump is doing his part with inept tariff policy.

I would not want to be in Powell’s shoes.

Tyler Durden

Fri, 06/20/2025 – 12:00

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://zerohedge.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.