Following the House-passed One Big Beautiful Bill, Senate Finance Republicans led by Chairman Mike Crapo (R-Idaho) on Monday released their draft version of the tax provisions for inclusion in Republicans’ budget reconciliation bill.

The Senate tax package delivers on President Trump’s campaign pledge to make the 2017 tax cuts permanent, providing across the board, pro-growth tax relief for American households and businesses.

As President Trump’s Treasury Secretary, Scott Bessent, stated in February, President Trump has a mandate from voters to make the 2017 Trump Tax Cuts permanent:

“President Trump has a mandate. He came in to do big things. And one of the big things that this administration wants to do is make the 2017 Tax Cuts and Jobs Act permanent. And that permanency will continue to make the U.S. the number one economy in the world in terms of growth. We are going to bring down inflation, we are going to cut regulations, and we are going to get the tax cut, the goal is still for them to be made permanent.”

The Senate’s tax package improves upon the House-passed bill by making the most pro-growth tax cuts permanent, greatly increasing economic growth and boosting take-home pay for American households.

Major Pro-Growth Tax Cuts Made Permanent in the Senate’s Package:

- Permanently Revives 100 Percent Expensing –

- Allows businesses to immediately expense 100 percent of the cost of qualified property acquired on or after January 19, 2025, reviving on of the most pro-growth provisions of the 2017 Tax Cuts and Jobs Act that is phasing out under current law. Without restoration of immediate 100% expensing, businesses were only allowed to immediately expense 40 percent of the cost for 2025 before it was scheduled to fall to 20 percent in 2026. Instead, 100 percent expensing is made permanent under this bill.

- Permanently Revives Research and Development Expensing –

- Allows businesses to immediately deduct domestic research or experimental expenditures paid or incurred in taxable years beginning after December 31, 2024. This provisions is made permanent in this bill. Under current law, taxpayers are required to deduct research or experimental expenditures over a five-year period while research or experimental expenditures that are conducted outside the U.S. are required to be deducted over a 15-year period.

- Permanently Restores Pro-growth Interest Deductibility (30 percent of EBITDA) –

- Restores the ability of businesses deducting net interest payments to include depreciation and amortization costs (Section 163(j)) for taxable years beginning after December 31, 2024. The Tax Cuts and Jobs Act (TCJA) signed into law by President Trump in 2017 allowed businesses to deduct net interest payments against their adjusted taxable income limited to 30 percent of to earnings before interest, taxes, depreciation, and amortization (EBITDA). However, this 30 percent limit tightened in 2022 as the EBITDA standard expired under law. The amount of interest deductions that businesses can take became limited to only using earnings before interest and taxes (EBIT), representing a significant tax increase on firms. Restoring the EBITDA-based interest limitation creates jobs, increases wages and grows GDP by 0.1 percent, according to the Tax Foundation.

Permanency for these Cost Recovery Provisions Increases Take-Home Pay up to $2,601

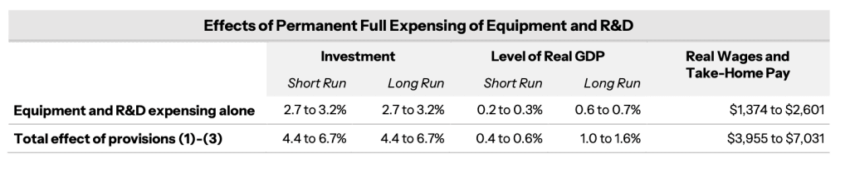

The Council of Economic Advisors released a May analysis examining the impact of President Trump’s broader proposed tax cuts, including permanently instituting full equipment and R&D expensing, relative to expiration of the Tax Cuts and Jobs Act after 2025.

The CEA report found that permanently instituting full equipment and R&D expensing alone would increase long-run GDP up to 0.7 percent, investment up to 3.2 percent, and real wages and take-home pay up to $2,601.

Here it is, straight from the report:

“The full expensing provisions push short-run GDP higher by 0.2 to 0.3 percent compared to the effect of the extension of low rates alone, with this marginal benefit growing to 0.6 to 0.7 percent in the long run. Long-run wages are an additional $1,374 to $2,601 higher as ab result of enacting the expensing provisions.“

Permanency for these Cost Recovery Provisions Doubles Growth Impact of the Bill

Similarly, The Tax Foundation concluded that prioritizing permanency for these provisions would more than double the economic growth impact of the House-passed version of the One Big Beautiful Bill.

Tax Foundation’s model found that permanently extending 100 percent expensing, research and development expensing and interest deductibility would by themselves boost long-run GDP by 0.8 percent and U.S. capital stock by 1.4 percent.

Americans for Tax Reform applauds the Senate’s tax package for making these pro-growth Trump Tax Cuts permanent.

Click this link for the original source of this article.

Author: Mike Palicz

This content is courtesy of, and owned and copyrighted by, https://www.atr.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.