If people have to work three jobs to make ends meet, politicians will say they “created” two new jobs, instead of taking the blame for the fact that no one can make enough money from just one job to stay afloat.

While Wall Street celebrates the 139K jobs supposedly created in May, while ignoring 95K in downward revisions to March and April, traders are also overlooking the household survey, which reveals a loss of 623K full-time jobs, partially offset by a 33K increase in part-time jobs.

— Peter Schiff (@PeterSchiff) June 6, 2025

Underneath the surface, worker productivity dropped in early 2025 while labor costs spiked. This isn’t a sign of a robust economy; it’s a warning of stagflation, where inflation keeps rising without real growth.

Other major economies like Europe and India are still cutting rates, making Trump froth at the mouth with envy. He rails that the U.S. is at a disadvantage because Powell won’t follow suit. But Europe and India are cutting rates because their economies are struggling, not because they’ve cracked the code on prosperity.

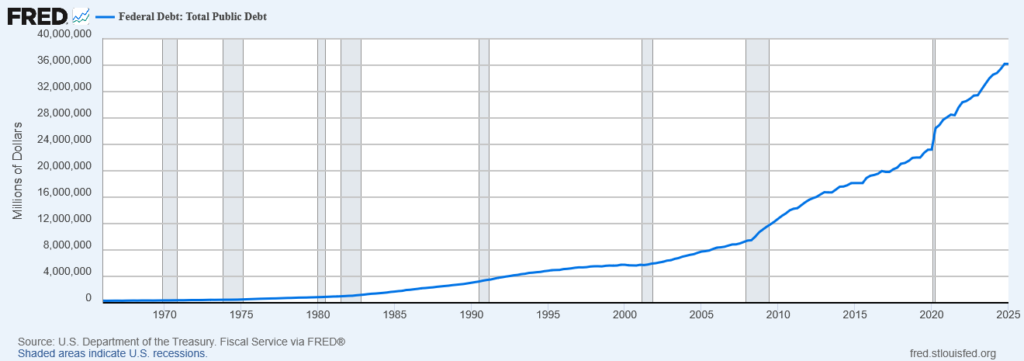

Trump says that America is being “ripped off” by the rest of the world as justification for policies that actually reverse everything that has allowed America to stay high on the hog at their expense. With no production, no manufacturing, a brain drain, out of control debt, and out of control spending, we’ve been able to export everything from our inflation to our trash to other countries, enjoying an incredible standard of living in spite of barely producing anything domestically.

The President’s push to scrap the debt limit is equally reckless. By taking a page from Elizabeth Warren’s book and advocating for unlimited borrowing, Trump is paving the way for a new debt crisis that could dwarf anything we’ve ever seen. His so-called “Big, Beautiful Bill” is a prime example of fiscal irresponsibility. This bill won’t grow the economy—it will balloon spending and debt, weaken the dollar, and drive up inflation and long-term interest rates.

As Peter Schiff said last week:

“…the Big, Beautiful bill is in reality the largest tax increase in history.”

The Congressional Budget Office’s deficit forecasts are optimistic, as the inflationary impact of this spending spree will compound the problem. Even Elon Musk, a supposed ally, criticized the bill’s excesses, leading to an epic falling-out of the strangest friendships in political history.

With DOGE becoming a laughably miniscule set of cuts that failed to make a visible dent, Americans aren’t getting the meaningful fiscal reform they voted for. Instead, they’re getting a lot of fanfare and a token gesture. Trump’s response? Codify these paltry cuts into his bloated bill and call it a win.

This brings us back to Powell’s replacement. Trump’s public attacks on the Fed Chair—whom he announced he was appointing in 2018—have intensified, with more and more reports regarding his plan to replace Powell with a more compliant successor. It would have to wait until Powell’s term ends in May 2026.

Replacing Powell with a yes-man who will print money on demand risks hyperinflation and a collapse in confidence in the dollar; but then again, printing money is all any central banker really knows how to do. This is bullish for gold but could trigger an epic crash where sputtering markets puke as soon as the money printer gets turned off again. Cutting rates now would increase inflation and push long-term interest rates higher, not lower.

Trump’s policies are also driving up oil prices, further undermining his claim that inflation is under control and that his policies are making gasoline more affordable. Higher oil prices will soon rear their heads in the Consumer Price Index. Meanwhile, Trump’s chaotic tariffs, which he touts as a way to boost domestic production, will disrupt supply chains and raise costs for consumers, leading to crashing demand.

Trump wants cheap money to goose the economy before the inevitable crash, leaving someone else to clean up the mess. The U.S. debt-to-GDP ratio is already over 120%, and with Trump’s plans to borrow more, we’re on a collision course with crisis. The dollar’s status as the world’s reserve currency is at risk, and when that’s gone, America as we know it is finished.

Total Public Debt, 1965 to Present

Trump’s pressure on the Fed, his push to abolish the debt limit, and his token DOGE cuts are a toxic combination that threatens to inflate the currency into oblivion. He’s undermining every factor that has enabled America’s exorbitant privilege for so long. But that privilege was always doomed to eventually be lost, and in fact, that’s exactly what’s needed for a massive global correction and a reshuffling of the global monetary order, with a gold standard.

That’s the only way that real price discovery can begin to take over, and America can learn to thrive again under a free market.

Now, even top brass at the Fed say they’re worried about debt, spending, and inflation. But to fix it, we need less central planning, a hard money standard, and a lot of economic pain as the country readjusts its expectations and markets recover from their addiction to aggressive tinkering, “Big, Beautiful Bills,” and central bank money printing.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.