As we head into the second half of the year, the 25 names I’ve been watching for 2025 continue to vastly outperform the S&P 500 index. Let’s take a look at where things stand as of mid-day Wednesday, and I’ll share my continued take on the market as we head into June and July.

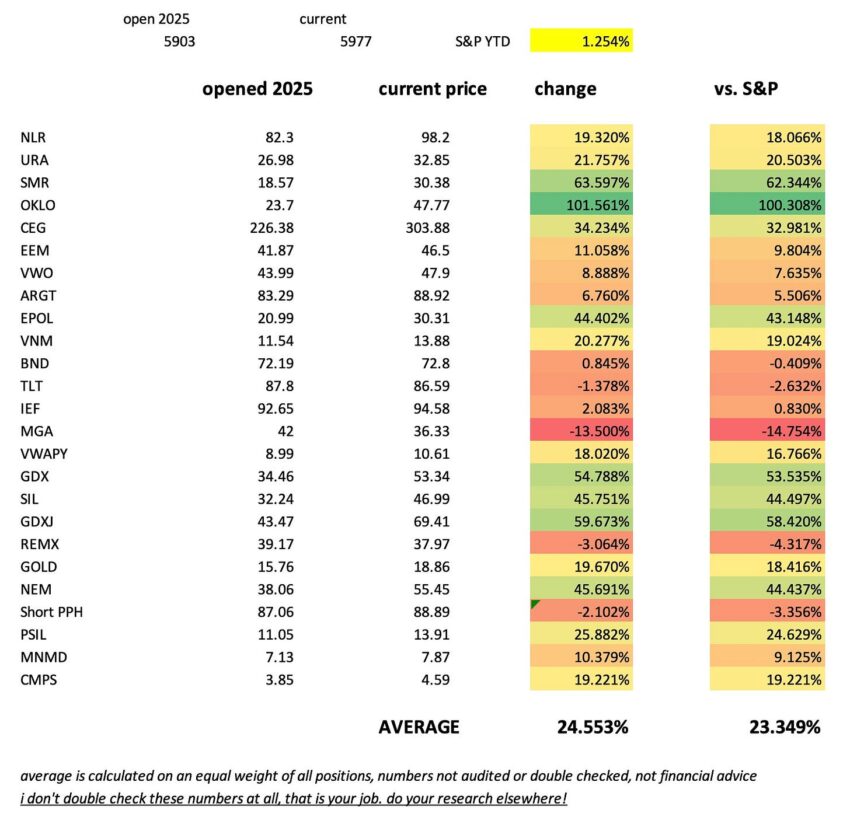

On an equal weighted basis, the below chart shows my 25 names for the year are up 24.55% compared to the S&P 500, up only 1.26%.

(Keep in mind these numbers may vary depending on what time you pull the stock quote. Make sure you double-check your own work, and take all of my numbers—always—with a grain of salt. Read the disclaimer at the bottom of this piece if you have any questions.)

The names have mainly benefited from two major secular trends I identified heading into the year: precious metals miners and nuclear energy.

Precious Metals Miners

Gold and silver miners—often leveraged to the underlying precious metal prices—have been in an uptrend alongside the metals themselves for the last year or two. But only now do they seem poised to potentially lead the metals higher, rather than lag them.

For the last year or so, gold miners, for example, have barely inched higher even as gold prices themselves have surged. Miners have had to climb a wall of worry because they’re more speculative than holding the metal itself. They carry counterparty and management risks, as well as costs associated with the capital-intensive process of mining.

It seems to me that we needed to reach a certain level of confidence in the underlying metals maintaining their elevated status before the miners would become more attractive—since they’re higher up on the “risk totem pole.”

Late last week and early this week, miners’ moves exceeded those of the underlying precious metals, as both gold and silver headed toward recent highs. This tells me that miners could be in the very early stages of becoming a “FOMO trade.” I’ve often joked that I’d be looking to sell miners when they become the everyday talking point on CNBC—the “can’t miss” trendy trade of the day.

We’re so far from that still that I truly believe miners could still rise multiple times from their current levels as they eventually fall into favor with the broader investing public.

There’s no reason to believe that gold and silver are going anywhere anytime soon, either. With ongoing debates about Trump’s “one big, beautiful bill” taking place, the bond market remains on edge, and the U.S. is still teetering on the edge of a fiscal cliff—or debt doom loop. If there’s an easy, simple solution to the United States’ fiscal problem, I sure as hell can’t see it.

There are two great podcasts you should listen to that sum up what to look for in the bond market, as well as how the global economy is reconfiguring itself to potentially use gold as a neutral reserve asset and medium of trade.

The first is Andy Schectman on Thoughtful Money talking about the insatitable demand for gold and silver:

The other is Bill Fleckenstein on the same podcast talking about our fiscal picture and the bond market:

Between the entire global monetary system appearing on the verge of a reset, and continued geopolitical risks—like those between Iran and Israel, or Russia and Ukraine—gold still looks like one of the safest bets on the board, even at its near-term elevated prices. I continue to buy miners on a recurring basis and add to my bullion collection regularly, regardless of price.

Nuclear Energy

I’ve been saying that nuclear energy is the only “common sense” solution to the energy crisis long before AI data centers became a talking point. Now, with AI data centers emerging as a principal demand driver for energy going forward, nuclear seems like an even more obvious solution.

The wheels to prioritize nuclear energy at the top of the power generation checklist are already in motion. Countries around the world are restarting nuclear power plants, and the United States is doing the same. President Trump recently signed new executive orders aimed at accelerating the development of nuclear energy and prioritizing permits for new small modular reactor (SMR) projects like those we’re seeing from tickers like SMR and OKLO.

These orders streamline Nuclear Regulatory Commission licensing to an 18-month process, promote small modular reactors (SMRs), and open up federal lands for new projects, particularly to support AI data centers and military installations.

Meanwhile, tech giants like Meta are investing heavily in nuclear. Meta signed a 20-year deal with Constellation Energy to buy 1.1 GW of nuclear power from Illinois’ Clinton Clean Energy Center, starting in 2027.

So far this year, the prices of all my nuclear picks have skyrocketed due to incessant positive headlines for the industry. At some point, these prices will need to be supported by actual nuclear production and the deployment of small modular reactors. But for now, I think continued positive headlines should keep a floor under these names heading into the second half of the year.

I think these two industries, mining and nuclear, can continue to outperform the S&P 500 as we head into the back half of the year—especially if the broader market pulls back.

Psychedelics

As I said last month, I’ve watched the pharmaceutical industry drift slowly away from the status quo under RFK, Jr. and therefore still believe psychedelics will eventually be growth names worth owning.

Since taking over as Health and Human Services Secretary in early 2025, Robert F. Kennedy Jr. has shaken up the medical establishment by firing 20,000 staff—including 3,500 at the FDA—eliminating departments he deemed ineffective, and mandating placebo trials for all new vaccines. By the way, remember two years ago when it was a faux pas to suggest shorting Moderna? How things have changed.

The FDA has been steadily progressing in regulating psychedelic drugs for medical use, recognizing their potential benefits while emphasizing scientific rigor. In 2023, the agency issued its first draft guidance for psychedelic drug trials, outlining key considerations like safety monitoring and placebo challenges. Additionally, the FDA hosted a public workshop in 2024 to refine clinical trial approaches, signaling a collaborative stance with stakeholders.

Despite this progress, challenges remain. In August 2024, the FDA rejected an MDMA therapy application for PTSD due to concerns over study design and safety. This decision has prompted other developers to reassess their approaches. However, the FDA continues to support psychedelic research, including granting breakthrough therapy status to LSD-based treatments for anxiety. Overall, the agency is cautiously moving forward, balancing innovation with patient safety.

I still like these names – PSIL, CMPS, MNMD – as call options on potential growth in psychedelics.

The Market

I don’t want to repeat the same diatribe I deliver every month about how overvalued the market is and how valuations don’t seem to reflect any semblance of the underlying economy (you can read it all, with charts, here).

If this market was playing by any type of rules or fundamentals, equity prices would be significantly lower—period. But that’s simply not the case.

This market is driven by the passive bid, mindless speculation, and zero-day-to-expiration options—nothing more. Absent gold miners and maybe a few consumer staples, there is no “value” in this market to buy.

The more rampant the speculation and outright gambling using options, the harder the market will whip back in the other direction when it inevitably crashes again. We got a taste of this during “Liberation Day,” when the market fell more than 20% over just a few days. Now imagine what would have happened if that crisis hadn’t been alleviated by the U.S. capitulating on tariffs and liquidity once again rushing back in to bail everyone out.

Take CoreWeave as a perfect example.

The company could barely find a bid heading into its IPO—so much so that one of its existing suppliers/customers, Nvidia, had to come in and put a floor under the IPO at $40 per share. Keep in mind that the circuitous nature of the relationship between CoreWeave and Nvidia has already been under scrutiny for more than a year now.

So you have a somewhat related-party transaction that bails out a company IPO, which had no bid at $40 per share—and then, somehow, weeks later, the company is trading at $150 per share. How does this happen? My guess is that someone lit a fire under the equity by making large out-of-the-money call option purchases to start the move higher. As that happened, retail traders—without any care for fundamentals or risk—also piled into out-of-the-money calls. The ensuing delta hedging forced on the sellers of these calls continued to drive the stock higher, and lo and behold, we have another situation where, in my opinion, an absolutely worthless company has tripled in price for no reason at all.

Reminds me of a certain car company back in December 2019.

If there were no options market, what would be needed to justify a nearly quadrupling of this company’s stock price in the month after it couldn’t even find a bid for its IPO?

It just doesn’t make any sense—and that’s how I know the current bid is likely bullshit where it sits today. These names are impossible to short because you never know when they’re going to keep “GameStopping” higher. It’s also very, very convenient for Nvidia—who may have stuffed their pockets with shares at $40—to be up multiples on their original investment just a month after they had to bail the company out.

Really funny how that works, isn’t it?

Anyway, this gaming of stocks using options is a microcosm of the entire market in general. The U.S. economy stands on the razor’s edge of hyperinflation and default, with a bond market moving in the opposite direction that most people expect.

Worthless companies continue to skyrocket. The crypto world is flush with hundreds of billions of dollars in worthless “coins” that serve no purpose. The housing market feels like it could start collapsing any day. Consumer delinquencies continue to rise. And yet the stock market acts like everything is just fine and dandy.

So far, even as recently as “Liberation Day,” we’ve always found a way to bail ourselves out of a cascading fall in equity markets. At some point, the market won’t come back—at least not in the short term. Trying to time the exogenous event that will cause this is a fool’s errand. I remain slightly hedged with some index puts at any given time, but for the most part, I’m hovering around a net neutral to long bias, hoping that my stock-picking for the year keeps me buoyed above the market averages, no matter which direction they move.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Click this link for the original source of this article.

Author: Quoth the Raven

This content is courtesy of, and owned and copyrighted by, https://quoththeraven.substack.com feed and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.