The Congressional Budget Office (CBO) has a long history of bad scoring.

In recent history, as this post highlights, the CBO has been caught underestimating corporate revenues after the passage of TCJA by over $100 billion, underestimating the cost of Biden’s green new deal subsidies by hundreds of billions of dollars, and using erroneous methods to calculate insurance coverage.

Notably, when the CBO gets it wrong, the scoring is always in the Left’s favor.

This significant disparity between the CBO’s estimates and the actual data should give Americans pause. Especially now, as the CBO has wildly underestimated growth and misrepresented health insurance coverage loss in its scoring of the President’s One, Big, Beautiful Bill.

As Speaker Mike Johnson explains, these estimates are absurd:

“The CBO is notorious for getting things WRONG. So, what does it get wrong about the One Big Beautiful Bill? A lot.

It assumes a historically low growth rate of just 1.8%.

But POTUS’s bill will be jet fuel for America’s economy. He delivered the best economy in the world during his first term, and it’s about to happen again with the help of this legislation.”

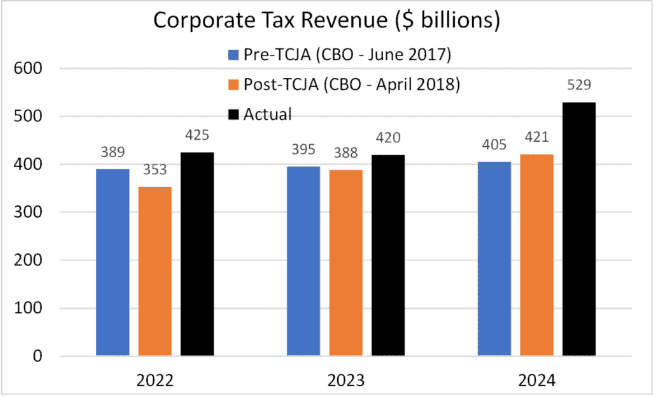

After TCJA, the CBO underestimated corporate receipts by over $100 billion.

Last year, the CBO released fiscal year 2024 numbers showing that corporate receipts came in at $529 billion. This number exceeded the $525 billion forecast in CBO’s June 2024 report and substantially exceeded CBO’s $421 billion prediction made after the passage of the Tax Cuts and Jobs Act (TCJA).

Despite Democrats asserting for years that TCJA would bankrupt the country, it is now obvious that was not true:

To be clear, tax revenues are not and should not be the only factor when considering the efficacy of a corporate income tax cut or hike. The reason the CBO’s estimates have been so inaccurate is because they do not consider the economic growth that occurs after a rate cut. Most importantly, regardless of when the loss in revenue is completely “paid for” in growth, the real benefits are delivered to workers and consumers.

The corporate income tax is passed on, almost entirely, to workers and consumers. Therefore, any reduction is a benefit to the American people.

Tax revenue arguments are the primary way Democrats try to scare the American people into opposing having more money in their own pockets. Still, they cannot escape the simple fact that businesses and individuals will always spend money more efficiently than the government can. Without taking this into account, tax cut revenue predictions will always be insufficient. Certainly, these predictions are not compelling tools for villainizing policies that, objectively, help the American people.

CBO underestimated cost of Inflation Reduction Act’s green new deal subsidies by more than half.

The IRA created or expanded several energy subsidy provisions: four clean vehicle credits, residential clean energy credit, energy efficient home credit, clean hydrogen production credit, clean electricity production tax credit, advanced energy project credit, etc.

When passed, the Congressional Budget Office (CBO) and Joint Committee on Taxation (JCT) estimated that energy-related IRA subsidies would cost about $370 billion over a ten year window. Just two years later, the CBO itself puts the cost at over double its original estimate – $786 billion.

Worse, in April 2023, the Penn Wharton Budget Model, which initially estimated $384.9 billion over ten years, updated their estimate to $1.05 trillion over ten years for just the climate and energy provisions.

As of November 2024, the U.S. Department of the Treasury expenditures report now estimates that the IRA green credits will cost $1.16 trillion from 2025 to 2034.

Most recently, in March 2025, the Cato Institute released a policy analysis finding the upper bound cost of the IRA green credits to be $1.97 trillion over ten years.

The way the CBO calculates insurance coverage changes is misleading, gives Democrats erroneous talking points about Medicaid reform.

The CBO’s preliminary estimate on coverage changes estimates 7.6 million people would go uninsured under the bill’s Medicaid changes.

Of course, this estimate is misleading and, at best, in desperate need of context. Of the 7.6 million, 1.4 million of these recipients are illegal immigrants who would be kicked out of the program and 1.2 million are those who are simply ineligible for the program (as current law stands).

The CBO also, mistakenly, assumes non-expansion states will eventually pass Medicaid expansion, so hundreds of thousands of the estimated “loss” in coverage is based on unfounded, anticipated growth of the program. Finally, the remaining 4.8 million people “losing” coverage are able-bodied adults who choose not to work.

This, of course, assumes that these folks will not start working in light of the policy change. In reality, where Medicaid work requirements have been tried, like in Tennessee and Arkansas, there were sharp increases in employment, labor force participation, and, most promising, private insurance coverage. In fact, people are better off when they are active members of their community, making money, and receiving employer-provided health insurance.

Click this link for the original source of this article.

Author: Isabelle Morales

This content is courtesy of, and owned and copyrighted by, https://www.atr.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.