The 2023 tax filing deadline is April 15, 2024 for most taxpayers. So if you haven’t submitted your tax return yet, you may need to file for an extension with the IRS.

And there are a few ways you can do that.

How to file a tax filing deadline extension

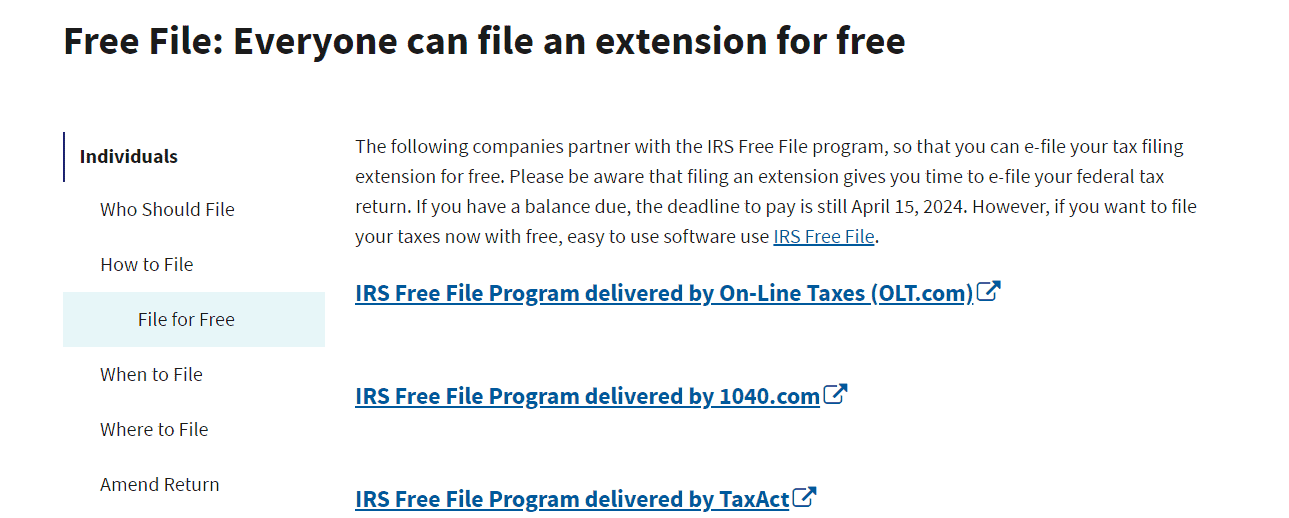

In order to qualify for a tax filing extension, you must apply for one by April 15. You can do this online via the IRS Free File page to request an automatic tax-filing extension that would push the deadline to October 15, 2024.

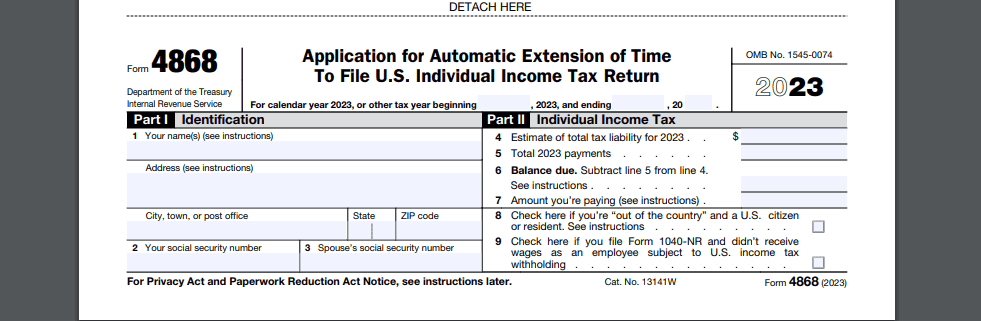

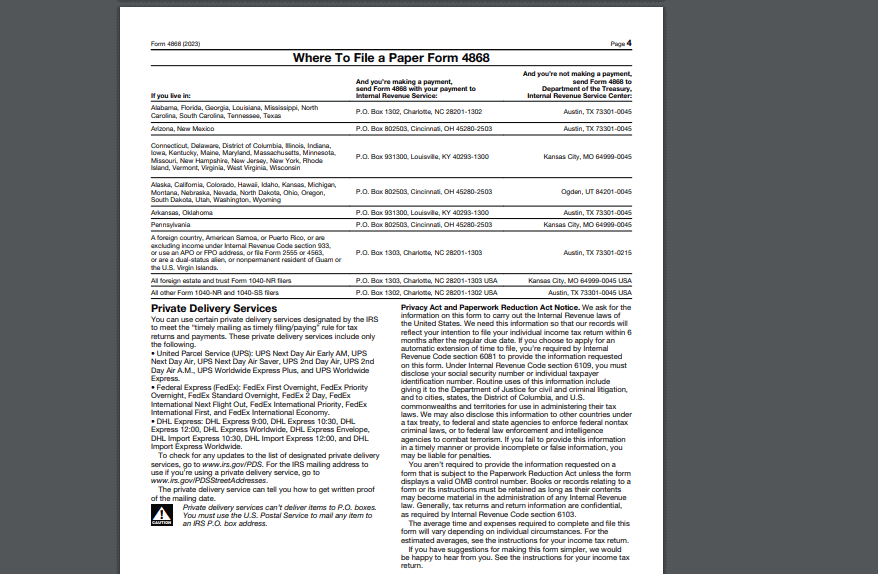

You can also file for a tax filing extension by filling out and submitting IRS Form 4868 by mail to the IRS. Just make sure it’s postmarked and stamped by April 15.

Some taxpayers may automatically qualify for a tax filing extension if they meet these criteria.

- Serving in a combat zone or a qualified hazardous duty area

- Living outside the United States

- Qualify for tax relief in disaster situations as designated by the Federal Emergency Management Agency (FEMA)

Can I apply for a tax payment extension?

If you owe taxes, you’d need to make a payment by April 15 or face penalties and interest charges. The IRS recommends you pay at least your estimated tax liability by the regular deadline to avoid penalties and interest charges.

You can also be eligible for an extension by electronically paying all or part of your estimated income tax due and letting the IRS know it’s for an extension. You can pay your estimated taxes by using any of the following.

- Your IRS Individual Online Account

- Direct Pay, which links to your bank account

- The Electronic Federal Tax Payment System (EFTPS)

- IRS2Go app

- Credit or debit card

Late payment penalties are typically 0.5% of the unpaid taxes for each month or part of a month the tax remains unpaid with a cap of 25%.

If you face a failure to pay and a failure to file a penalty in the same month, the IRS reduces the failure to file a penalty by the amount of the failure to pay penalty applicable in that month. So instead of a 5% failure to file penalty for the month, the agency would apply a 4.5% failure to file penalty and a 0.5% failure to pay penalty.

If you file your return more than 60 days late, the minimum penalty would be the lesser of $485 or the balance of the tax due.

How to apply for a payment plan

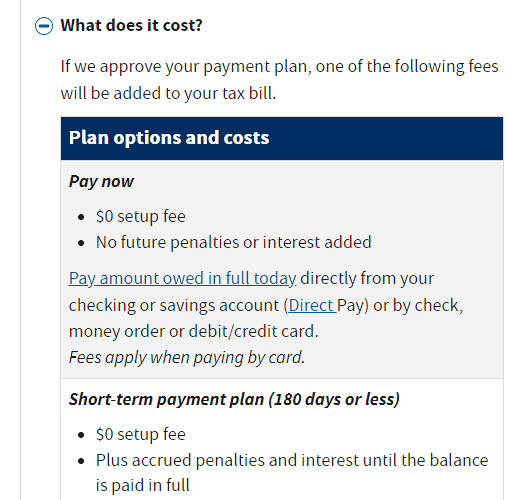

If you can’t pay your taxes in full by the Tax Day deadline, you can apply for a payment plan. You can pay off your balance in monthly installments or through a short-term payment plan that can last 180 days or less.

To qualify for a short-term payment plan, you need to owe $50,000 or less in combined tax, penalties and interest. And you must file all necessary returns. For a long-term payment plan, you’d need to owe less than $100,000 in combined tax, penalties and interest.

You can apply for a payment plan online. But you’d need a valid photo ID to verify your identity through ID.me. Additionally, you’d need your bank routing and account numbers to set up a payment plan.

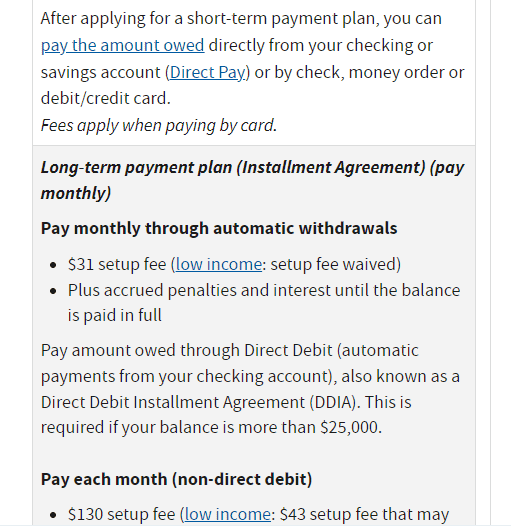

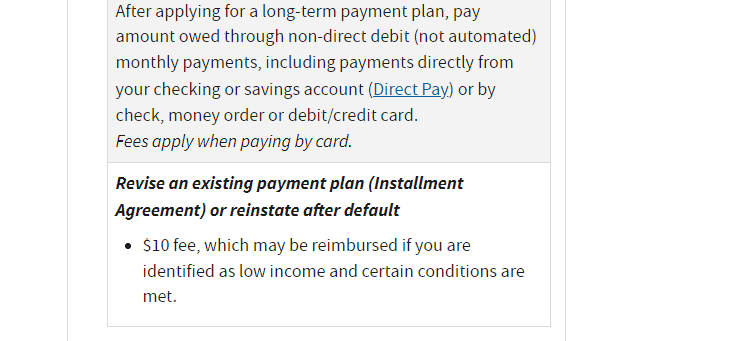

Setting up a payment plan may require a fee.

If you filed your tax return on time and the IRS approved your payment plan, the agency would reduce the failure to pay penalty to 0.25% per month or partial month that your payment plan is active.

It’s important to file your taxes on time even if you don’t owe taxes. This would ensure any tax refund owed to you gets to you promptly.

Will tax refunds be larger in 2024?

The average refund has been $3,050 as of March 29, 2024. That’s a nearly 5% increase from the same time in the previous year, according to IRS data.

Much of this increase has been a result of IRS measures to combat the effects of recent inflation. The standard deduction has risen by 7% for 2023 tax returns.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

The post 2024 Tax Deadline Extension: How To Quickly Check If You’re Eligible And Apply appeared first on 24/7 Wall St..

Click this link for the original source of this article.

Author: Javier Simon

This content is courtesy of, and owned and copyrighted by, https://247wallst.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.