Global markets and US equity futures extended a selloff as Trump’s sweeping import tariffs sparked renewed fears about the outlook for economic growth amid traders. The MSCI All Country World Index fell for a sixth day, the longest streak since September 2023. As of 8:00am ET, S&P futures on the S&P 500 retreated more than 1%, suggesting the index will extend a three-day run of declines. In premarket trading, Amazon.com slumped as much as 8%

and weighed on Big Tech after projecting weaker-than-expected operating income, prompting questions about its huge AI spending; Elsewhere AAPL (+1.7%) rallied on iPhone sales growth including while other Mag 7 names are mostly lower NVDA (-.25%), GOOG/L (-2.2%) and META (-1.3%) as Consumer Discretionary and Healthcare underperform. In rates, 30y TSYs added 3.2bps. Commodities are mixed, with precious metals higher and base metals lower. Today’s economic data slate includes July jobs report (8:30am), July final S&P Global US manufacturing PMI (9:45am), and July ISM manufacturing and July final University of Michigan sentiment (10am)

In premarket trading, Mag 7 stocks are mostly lower: Amazon.com slides 7% after projecting weaker-than-expected operating income and trailing the sales growth of its cloud rivals, leaving investors searching for signs that the company’s huge investments in artificial intelligence are paying off. Apple rises 1.8% after the company reported its fastest quarterly revenue growth in more than three years, easily topping Wall Street estimates, after demand picked up for the iPhone and products in China. Others are mostly in the red (Microsoft +0.5%, Meta -1%, Tesla -1.2%, Alphabet -1.8%, Nvidia -2%).

- Avantor (AVTR) slumps 10% after the maker of laboratory supplies reported adjusted earnings per share for the second quarter that missed the average analyst estimate.

- CCC Intelligent Solutions (CCCS) climbs 15% after the software company reported revenue for the second quarter that exceeded the average analyst estimate.

- Coinbase (COIN) falls 11% after the largest US crypto exchange reported revenue for the second quarter that missed the average analyst estimate following a drop in digital-asset market volatility.

- Eli Lilly & Co. (LLY) ticks up as much as 2.5% after the Washington Post reported that the US government plans to experiment with covering weight-loss drugs for federal health programs.

- First Solar (FSLR) advances 2% after the renewable energy firm boosted its net sales forecast for the full year.

- Fluor (FLR) tumbles 17% after the engineering and contracting firm cut its adjusted earnings per share guidance for the full year.

- Kimberly-Clark Corp. (KMB) rises 3% after raising its full-year guidance after reporting the strongest volume growth in five years.

- Lumen Technologies (LUMN) falls 5% after the telecommunications firm posted 2Q revenue came in just shy of estimates.

- Moderna (MRNA) falls 5% after the struggling biotech company narrowed its revenue forecast for the full year.

- Reddit (RDDT) rises 16% after the social-networking company forecast revenue for the third quarter that beat the average analyst estimate.

Late on Thursday, Trump announced a slew of new levies, including a 10% global minimum and 15% or higher duties for countries with trade surpluses with America, as he forged ahead with his turbulent effort to reshape international commerce. Questions about the impact on growth and inflation are starting to overshadow the AI-driven optimism that has buoyed megacap technology stocks.

“Next week marks a significant turning point for global trade with the introduction of Trump’s tariffs, creating uncertainty about how these new and historical barriers will affect markets in practice,” said Kim Heuacker, an associate consultant at Camarco. “Current high valuations, particularly among US stocks, are becoming increasingly difficult to justify.”

Trump’s baseline rates for many trading partners remain unchanged at 10% from the duties he imposed in April, easing the worst fears of investors after the president had previously said they could double. Yet, his move to raise tariffs on some Canadian goods to 35% threatens to inject fresh tensions into an already strained relationship.

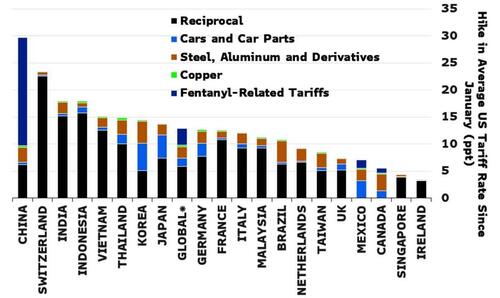

Taken together, the average new tariff rate rises to 15.2% from 13.3% — up significantly from 2.3% in 2024, according to Bloomberg Economics. The biggest losers appear to be China and Switzerland, Bloomberg economist Maeva Cousin says.

Now that tariff news is in the bag, all eyes turn to today’s jobs report: the US economy is expected to have created 104,000 jobs in July, down from 147,000 a month earlier. The “whisper” is for 120,000. According to JPMorgan, either would be good enough to take the S&P 500 higher (see our full preview here). Today’s closely-watched jobs report may give fresh hope to doves looking to make the case for the Fed to cut interest rates. There are fewer company updates to distract from payrolls, but a slew of new tariffs is dampening the mood.

“Given all the uncertainties, it makes a lot of sense for traders, for dealers to take some money off the table going into nonfarm payrolls today,” said Gareth Nicholson, CIO of Nomura International Wealth Management.

The Euro Stoxx 600 falls 1.2% to around a one-month low, tracking declines in Asia with pharmaceutical stocks including Novo Nordisk A/S, GSK Plc and AstraZeneca Plc leading declines after Trump demanded drug companies lower US prices. Travel, industrial and technology shares are also leading declines. The tariffs are “really bad for Europe,” said Ludovic Subran, chief investment officer at Allianz SE. “The cost for companies will be huge, as the US is the biggest market by far.” These are the biggest movers Friday:

- Campari gains as much as 8.8%, the most since April, after the Italian spirits maker reported 1H results. Adjusted Ebitda and sales for the period beat consensus estimates and the company left its full-year guidance unchanged

- Melrose Industries gains as much as 7.9%, the most in almost four months, after the aerospace company reported earnings ahead of expectations in the first half, which analysts at RBC say helps de-risk its full-year guidance

- Erste shares rise as much as 3.1% to a fresh all-time high after the bank raised its forecast for return on tangible equity and net interest income. Analysts at Morgan Stanley note strong capital position

- UMG shares fall as much as 8.9% after the music label reported Ebitda margin that expanded more slowly than expected during 2Q, with its merchandising unit being hit by higher tariffs and freight costs

- European pharmaceutical stocks drop after US President Donald Trump demanded drug companies lower US prices, and Novo Nordisk loses its spot among Europe’s 10 most valuable companies after nearly a weeklong slump

- Daimler Truck falls as much as 5.5% in early trade after the truckmaker lowered its outlook, citing the impact on sales from ongoing tariffs in North America. Order weakness in North America stood out, Citi says

- Saint-Gobain shares fall as much as 5%, the most in almost four months, after results from the French construction materials producer showed a slowing volume trend into the second-quarter

- J. Martins falls as much as 4.6% in early trading as 2Q earnings beat driven by rebound of like-for-like sales in Poland and better cost control is clouded by erosion of Portuguese retailer’s gross margin

- Engie falls as much as 8.3%, before trimming losses, after the French energy group said most earnings metrics fell year on year, with Jefferies seeing a 24% miss on Ebit ex-nuclear. Shares are down 3.1% as of 10.29am in Paris

- Cancom shares drop as much as 21%, the most since 2008, after the IT services provider cut its outlook for the full year, citing challenges in its core German market

- Mutares shares fall as much as 22% after the German Financial Supervisory Authority (BaFin) says in statement that there are concrete indications the investment firm has violated accounting regulations

Earlier in the session, Asian stocks were set to record their biggest weekly decline since April as Washington’s tariffs damped the outlook for the export-dependent region. The MSCI Asia Pacific Index dropped as much as 1% on Friday, with South Korean equities leading declines after authorities unveiled plans to raise taxes on corporations and investors. Tech shares weighed on the regional gauge as Tokyo Electron dropped the most in nearly a year following a move by the chip tool maker to lower its full-year earnings outlook. The retreat in the Asian index marks a reversal of the back-to-back weekly gains that helped propel it to the highest level since March 2021. Investors are watching the parameters and impact of trade deals, as well as factors such as central bank policy direction to plot their next move.

In FX, the Bloomberg Dollar Spot Index rises 0.2%, trading at the highest in two months after Trump fired his latest salvo at the Federal Reserve, saying in a social-media post the institution’s board should “assume control” if Chair Jerome Powell doesn’t lower interest rates. Traders are also bracing for key US jobs data later Friday. The Swiss franc is among the weakest G-10 currencies, falling 0.5% against the greenback after Switzerland was hit with a 39% levy by Trump. The yen outperforms, rising 0.2% after some modest jawboning from the Japanese Finance Minister.

In rates, treasuries are mixed, with outperformance at the short-end pushing 2-year yields down 2 bps. Gilts lead a selloff in European government bonds, with UK 10-year yields rising 5 bps.

In commodities, WTI crude futures fall 0.7% to $68.80 a barrel. Gold rises $5. Bitcoin falls 1%. Bitcoin is on the backfoot, and trades back below the USD 115k mark – downside which is in-fitting with the broader risk tone.

Looking at today’s US economic data calendar we get the July jobs report (8:30am), July final S&P Global US manufacturing PMI (9:45am), and July ISM manufacturing and July final University of Michigan sentiment (10am). Fed speaker slate includes Hammack (9:10am) and Bostic (10:30am)

Market Snapshot

- S&P 500 mini -1%

- Nasdaq 100 mini -1.1%

- Russell 2000 mini -1.5%

- Stoxx Europe 600 -1.3%

- DAX -1.8%

- CAC 40 -1.9%

- 10-year Treasury yield +1 basis point at 4.38%

- VIX +2 points at 18.69

- Bloomberg Dollar Index +0.2% at 1224.03

- euro -0.1% at $1.1402

- WTI crude -0.6% at $68.86/barrel

Top Overnight News

- Donald Trump set a 10% global minimum tariff, with rates of 15% and higher for countries with significant trade surpluses with the US. BBG

- Trump says he remains open to trade deals, and negotiations are set to continue despite the new tariff rates going into effect. NBC News

- Donald Trump will impose a 39% tariff on imports from Switzerland, one of the steepest levies globally which threaten to leave the country’s key exports reeling: BBG

- Trump again criticized Powell in which he called him ‘Too late’ and said he is a terrible Fed Chair.

- US held secret talks w/Moscow this week but failed to make progress on a ceasefire, and there isn’t much hope for Witkoff’s upcoming trip to Russia to change the situation. NYT

- Asia’s factory activity deteriorated in July as soft global demand and lingering uncertainty over U.S. tariffs weighed on business morale, private sector surveys showed on Friday, clouding the outlook for the region’s fragile recovery. Reuters

- China’s Caixin manufacturing PMI returned to contractionary territory in July, as softening new business growth led factories to scale back production, falling to 49.5 from 50.4 in Jun (the Street was modeling 50.2). WSJ

- Eurozone inflation: the headline Jul CPI ran a bit hot at +2% (flat vs. June and above the Street’s +1.9% forecast) while core was inline (and flat vs. June) at +2.3%, supporting the case for officials who say there’s no rush to keep lowering rates. BBG

- The US CDC told physician groups, public health professionals and infectious disease experts that they will no longer be invited to help review vaccine data and develop recommendations. BBG

- Big Tech’s runaway results this week showed sings that AI is beginning to boost earnings, easing investor concerns about the sector’s historic spending binge on the technology. Alphabet, Meta, and Microsoft were the clear winners, adding more than $350bn in stock market value after reporting double-digit increases in revenue and net income. MSFT became the 2nd company to reach $4tn mkt cap. FT

Earnings

- Amazon.com Inc (AMZN) Q2 2025 (USD) EPS 1.68 (exp. 1.33), Rev. 167.7bln (exp. 161.91bln), AWS net sales 30.9bln (exp. 30.77bln): Co. shares -8% pre-market

- Apple Inc (AAPL) Q3 2025 (USD): EPS 1.57 (exp. 1.43), Rev. 94.04bln (exp. 89.29bln), iPhone rev. 44.58bln (exp. 44.52bln), Services rev. 27.42bln (exp. 26.80bln), Mac rev. 8.05bln (exp. 7.26bln), iPad rev. 6.58bln (exp. 7.24bln), Wearables, Home & Accessories net sales 7.40bln (exp. 7.82bln), Americas rev. 41.20bln (vs. 37.68bln y/y), Greater China rev. 15.37bln (exp. 15.12bln): Co. shares +2% pre-market

Trade/Tariffs

- US President Trump announced tariffs on countries ranging from 10%-41% including a tariff rate of 10% for Brazil, 30% for South Africa, 20% for Taiwan and 25% for India, while the order stated “These modifications shall be effective with respect to goods entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time 7 days after the date of this order”.

- White House said President Trump signed an executive order modifying reciprocal tariff rates for certain countries, with the tariff on Canada increased from 25% to 35% effective August 1st, while it added that Trump determined it is necessary and appropriate to modify the reciprocal tariff rates for certain countries. Furthermore, it stated that countries listed in Annex I of the executive order will be subject to the tariff specified therein and countries not listed in Annex I will be subject to a 10% tariff, while goods transhipped to evade the 35% tariff on Canada will be subject instead to a transshipment tariff of 40%.

- US official said that if the US has a surplus with a country, the tariff rate is 10% and small deficit nations have a 15% tariff, while they are still working out technicalities of rules of origin terms for transshipment and will implement rules of origin details in the coming weeks. The official said the US has more trade deals to come and the challenge with India includes geopolitical differences over BRICS and Russia, as well as noted that differences with India cannot be resolved overnight and there is no final decision on China.

- US President Trump said on Thursday that they just made a couple of other trade deals a little while ago and later commented that Canada’s stance on a Palestinian state is not a deal-breaker. Trump also commented he may speak with Canadian PM Carney on Thursday night and he is open to further talks with Canada and open to more deals.

- US Commerce Secretary Lutnick said the China trade extension is up to US President Trump, while he stated if Canadian PM Carney complies, “maybe” Trump will reduce tariffs on Canada, but added that the 35% Trump sent in the letter is surely on the cards.

- White House Trade Adviser Navarro said the US is moving forward on progress with India, Canada and China, according to Fox News.

- Mexico’s Economy Minister Ebrard said the 90-day deal with the US was achieved without a concession from Mexico and they are moving closer to the renewal of their trade deal with the US. Ebrard separately commented that the tariff debate with the US includes concerns about intellectual property and the rules of origin panel, while he added that they have to address those issues from the perspective of revising the USMCA.

- Malaysian Trade Minister says “Pharma and Semiconductors are exempted from US tariffs”.

- Swiss Economy Ministry understands that the 39% tariff rate does not apply to pharmaceuticals.

- PBoC Deputy Governor met with US business delegation on July 29th, according to a statement, two sides had in-depth talks on US-Sino relations; China’s macroeconomic policies and the opening up of financial industry.

- India is engaged with US for further trade talks; US delegation to visit Delhi on August 24th, according to Reuters sources; India expects USD 40bln exports to impacted by the high US tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly subdued following the weak handover from US peers and as participants digested the latest Trump tariff adjustments ahead of the deadline and with the key US Non-Farm Payrolls report on the horizon. ASX 200 was pressured with underperformance in tech, healthcare and financials leading the declines in most sectors as sentiment is dampened amid trade uncertainty. Nikkei 225 slumped at the open but was well off today’s worst levels with a rebound facilitated by recent currency weakness. Hang Seng and Shanghai Comp were lacklustre mood following the latest S&P Global China General Manufacturing PMI (formerly sponsored by Caixin) which missed forecasts and surprisingly returned to contractionary territory. US equity futures lacked demand after declining on Thursday and with little impact seen following the mixed fortunes in the likes of Apple and Amazon post-earnings.

Top Asian News

- China’s MOFCOM announced tax credit policies related to direct investment by foreigners.

European bourses (STOXX 600 -1.3%) opened entirely in the red, and has continued to trundle lower as the August 1st tariff deadline passed. US President Trump announced new rates on 92 countries, which brought the average US tariff rate to 15.2% (prev. 13.3%, prev. 2.3% pre-Trump). European sectors are entirely in the red, in-fitting with the risk tone. Media is found right at the bottom of the sectoral list, pressured by post-earning losses in UMG (-6.3%); the Co. lowered its earnings forecast and highlighted rising content costs. Tech is also on the backfoot, as the sector cools from recent upside and as the risk-tone weighs.

Top European News

- Healthcare completes the bottom three, with US President Trump to blame; he sent letters to 17 pharma companies (in both US and Europe), asking them to lower drug prices before the end of September. The likes of Novo Nordisk (-4%) and GSK (-1.7%) both move lower, but are off worst levels.

FX

- DXY began steady with the USD showing a mixed performance vs. peers. Markets are currently digesting the fallout from the latest executive orders from US President Trump, which has seen the imposition of tariffs on countries ranging from 10%-41%. This includes a tariff rate of 10% for Brazil, 30% for South Africa, 20% for Taiwan and 25% for India. Canada’s tariff increased from 25% to 35%, while Mexico received a 90-day extension of the current tariff rates. Accordingly, the average US tariff rate has risen to 15.2% (prev. 13.3%; 2.3% pre-Trump). It’s also worth noting that the July payrolls release looms large with consensus looking for the rate of job growth to slow to 110k from 147k and the unemployment rate to rise to 4.2% from 4.1%. A soft outturn could reignite expectations of a September cut. Elsewhere, ISM manufacturing data is also due on deck and we expect to hear statements from Waller and Bowman on the justification of their dissent. As the morning progressed, the DXY gained a firm footing on a 100 handle with a current session high at 100.25.

- EUR steady vs. the USD with a firmer-than-expected outturn for Eurozone inflation unable to provide much traction for the shared currency. HICP Y/Y for July remained at the 2% target (Exp. 1.9%), whilst both core metrics came in 10bps over consensus, and services declined to 3.1% from 3.3%. For now, today’s NFP print is likely to provide the greatest source of traction for EUR/USD. Again, as the morning has progressed, the mentioned USD pickup has weighed with EUR/USD now just sub-1.14.

- JPY is marginally firmer vs. the USD in what has been a bruising week for the Yen vs. the dollar. Part of this has been a USD story and part has been stemming from the fallout from the latest Japan deal, political uncertainty and a reticence yesterday for the BoJ to attempt to bolster rate hike bets. The Yen depreciation has not gone unnoticed in Tokyo with the Japanese Finance Minister Kato stating that he is “alarmed over FX moves”. On the trade front, the Nikkei reports that Japan is eyeing a 15% rate for the US chip tariff, which would be on par with the EU. After hitting a multi-month high at 150.91 overnight, USD/JPY has pulled back but remains above the 150 mark and its 200DMA at 149.56.

- GBP remains on the backfoot vs. the USD with Cable extending its losing streak to a 7th session in a row. It remains the case that macro drivers for the UK remain on the light side, however, next week will see the latest BoE policy announcement and MPR, which is 82% priced for a 25bps reduction. Cable has slipped onto 1.31 handle for the first time since 13th May with a session low at 1.3142.

- NZD is underperforming its antipodean peer in the wake of the latest Trump tariff announcements, which has seen the rate for New Zealand increase to 15% from 10% and Australia hold steady at 10%.

- PBoC set USD/CNY mid-point at 7.1496 vs exp. 7.2033 (Prev. 7.1494).

Fixed Income

- USTs are slightly softer on the final day of a very busy week. For today, the highlights are July’s NFP report, ISM Manufacturing and expected explanations of dissent from Fed’s Bowman and Waller. Thus far, USTs have been holding around the low end of a 110-28+ to 111-00+ band. The bearish bias this morning appears to be tariff-induced (i.e. higher inflation, firmer yields). For NFP, the headline is seen at 110k (prev. 147k), Unemployment Rate at 4.2% (prev. 4.1%); post-Fed, Chair Powell said the unemployment rate is the figure to watch.

- Bunds are in the red, to a slightly larger degree than USTs but faring better than Gilts (see below). Pressure this morning is likely a function of the latest tariff measures from Trump, measures which have seen tariff increases for several key economies and as such biased yields across the curve with a clear steepening bias in the early morning; though, this does come after a period of flattening for the curve. No significant reaction to any of the morning’s PMI data (the EZ-wide figure was unrevised). The day’s main EZ event was July’s Flash HICP, printed hotter than expected for the three main Y/Y metrics with all measures remaining at the prior rate – again no real move.

- Gilts are on the back foot. No fixed income pertinent newsflow specifically for the UK. Pressure is likely a function of the global inflation implications of the latest tariff measures, as discussed. Currently, Gilts are lagging peers. However, this seems to be more a function of the bouts of relative outperformance seen over the last few days rather than a UK specific. Currently, at a 91.49 low and, despite the extensive 91.16-92.28 WTD range, set to end the week with near enough unchanged.

Commodities

- Crude is on the backfoot following Thursday’s macro-induced losses as markets awaited Trump’s revised tariffs. In terms of the highlights from the announcement, the average US tariff rate has now risen to 15.2% (prev. 13.3%; 2.3% pre-Trump). China was not mentioned; EU/UK/Japan had their rates as agreed; Switzerland, New Zealand, and Canada’s tariffs were increased, while Mexico pays a lower tariff for 90 days. WTI resides in a 68.70-69.55/bbl range while Brent sits in a USD 71.18-72.00/bbl range.

- Precious metals are mostly softer despite a relatively stable dollar (DXY oscillates around 100) and despite of the broad downbeat risk tone. Focus today on NFP, ISM Manufacturing and Fed speak. Spot gold resides in a USD 3,281.74-3,300.54/oz range at the time of writing, within Thursday’s USD 3,276.28-3,314.98/oz parameter.

- 3M LME Copper is relatively stable following Thursday’s slide, which saw the CME-LME arb collapse as the US copper tariff was not as bad as feared, as the 50% tariff applied to copper pipes and wiring, whilst omitting copper input materials such as ores, concentrates and cathodes. 3M LME copper prices reside in a USD 9,597.85-9,696.30/t range.

- Codelco said a worker died and nine were injured with five missing at the Andesita mine at El Teniente in Chile after a seismic event.

Geopolitics

- US President Trump said Iran has been acting very badly and their nuclear capability was decimated but added that Iran can start again.

- US President Trump said it is disgusting what Russia is doing and they are going to put sanctions on Russia.

- China cyber association accused the US of a cyberattack on the defence sector to steal secrets, according to Bloomberg.

- Ukrainian Presidential Office head says Ukrainian partners confirm “positive signals” from the White House on Russia sanctions.

d

US Event Calendar

- US economic data slate includes July jobs report (8:30am), July final S&P Global US manufacturing PMI (9:45am), and July ISM manufacturing and July final University of Michigan sentiment (10am)

- Fed speaker slate includes Hammack (9:10am) and Bostic (10:30am)

DB’s Jim Reid concludes the overnight wrap

Welcome to August, which begins with the deadline now having been passed for tariff deals to be concluded with the United States. Much of the rhetoric and the negotiation are now behind us and we’ll now see how the rubber hits the road. The US tariff rate has risen to about 15% from a little over 2% at the start of the year. That’s their highest level since the 1930s but that has not prevented US equities from being near their all-time highs and other markets being much stronger this year.

With just a few hours to go before the August 1 deadline, last night President Trump signed an executive order outlining a new set of tariffs, including a 10% global minimum and duties of 15% or higher for countries with trade surpluses with the US. Some of the higher rates that had not previously been confirmed included 39% on Switzerland and 20% on Taiwan. The tariffs are due to take effect after August 7 which, while being a delay for technical implementation, could leave open the possibility of more countries agreeing deals in the next week. Trump also announced that tariffs on Canadian goods would rise from 25% to 35% immediately (though goods compliant with the United States-Mexico-Canada Agreement would remain exempt which reduces the impact). So, Canada is being singled out to a degree.

Earlier in the day, following a meeting with Mexican President Claudia Sheinbaum, President Trump announced a 90-day extension in trade negotiations between the US and Mexico. During this period, Mexico will continue to pay a 25% tariff on non-USMCA compliant goods and cars as well as 50% on steel and aluminium. In exchange, Mexico has agreed to immediately eliminate its non-tariff trade barriers.

Meanwhile, the US Court of Appeals began hearing arguments yesterday regarding Trump’s use of tariffs, with a ruling expected “within weeks,” according to Bloomberg. The first hearing yesterday saw some sharp questions from judges on the administration’s use of International Emergency Economic Powers Act to set broad tariffs. Ahead of the hearing, Trump posted on Truth Social, warning that if the US cannot defend itself using “tariffs against tariffs,” the country would be “dead, with no chance of survival or success.”

Equity markets have seen contrasting themes over the last 24 hours as a resurgence of US “tech-ceptionalism” was offset by a broader loss of momentum.” The Mag-7 gained +1.39% to a new record high, buoyed by impressive earnings from Microsoft (+3.95%) and Meta (+11.25%), whose valuations continued to climb. Microsoft posted its largest daily gain since early May and briefly surpassed a $4 trillion market capitalisation, placing it just behind Nvidia as the world’s second-largest company.

However, the broader equity mood turned more cautious as the US session went on, with the S&P 500 retreating from its early peak of +1.01% just after the open to close -0.37% lower. And the small-cap Russell 2000 fell by -0.93%, moving back into the red YTD. While month-end effects may have played a role in this softening, there were also specific headwinds. Healthcare stocks (-2.79%) were the laggards in the S&P after Trump sent letters to 17 of the largest pharma companies, demanding they charge the US the same as other countries for new medicines and giving the companies 60 days to voluntarily comply. The Philadelphia Semiconductor index slid -3.10% after underwhelming results from Qualcomm (-7.73%) and ARM Holdings (-13.44%).

After the US close, we saw mixed results from Apple and Amazon. Apple’s shares gained around 2% after-hours following a strong revenue beat ($94bn vs $89.3bn est.) amid the strongest sales growth in more than three years which CEO Tim Cook ascribed to an acceleration across many markets including China. On the other hand, Amazon lost ground as it projected weaker-than-expected Q3 operating profits ($15.5-$20.5bn vs 19.4bs est.) and saw weaker cloud growth than rivals. Against this background, US futures are indicating a negative start with those on the S&P 500 (-0.15%) and NASDAQ 100 (-0.20%) edging lower.

On the data front, June’s US core PCE—the Fed’s preferred inflation gauge—rose by +0.3% month-on-month, in line with expectations. However, the year-on-year rate came in a tenth above forecast, which was hinted at by revisions in Wednesday’s GDP report. This will not go unnoticed by the Fed, especially as it exceeds the level targeted by Governor Waller, one of the two dissenters arguing for a cut at the FOMC this week. Initial jobless claims leaned hawkish, coming in at 218k versus 224k, while continuing claims were -7k below forecast at 1946k. The Employment Cost Index (ECI) for Q2 also surprised to the upside at +0.9%, a tenth above expectations. These figures are likely to draw more attention from the Fed than the personal spending data, which came in a tenth below expectations at +0.3% for June. The generally solid data saw pricing of Fed cuts by year-end decline by another -3.4bps to only 33bps. 2yr Treasury yields rose +1.5bps, while 10yr yields (+0.4bps) were steady.

Staying with data, today brings the latest US payrolls number. Our US economists expect headline payrolls to slow to +75k in July (from +147K in June) amid payback from a likely seasonal June spike in education employment, and private payrolls to gain +100k (previously +74K in June), with the unemployment rate edging up to 4.2%. You can sign up for their post-employment call to discuss the data and the impact on the Fed outlook here.

While the data supported Chair Powell’s cautious stance, Trump launched one of his most pointed attacks yet on the Fed Chair, accusing him of “costing our country trillions of dollars” and being “too political to have the job.” Treasury Secretary Scott Bessent made some more softly critical remarks on CNBC, suggesting it would be “highly unusual” for Powell to remain on the Fed Board after his term ends next May. He added that the White House would begin interviewing candidates for the Fed, with a nomination announcement expected “by year-end.”

In the euro area, 10-year yields fell by 1-2bps across the board, while 2-year yields edged up slightly. Inflation data from France, Italy, and Germany was mixed. Italy’s CPI surprised slightly to the upside at +1.7% year-on-year (vs. +1.6% expected), driven by a rise in food inflation (3.9% vs. 3.3%). Germany’s July CPI, however, came in slightly below expectations at +1.8% (vs. +1.9%). Following the country releases, our European economists see this morning’s euro area headline inflation release tracking for a low +2.0% reading (consensus +1.9%) with core HICP set to hold steady at +2.3%.

European equities were more subdued ahead of the US tariff hike. The STOXX 600 fell by -0.75%, with wine and spirits companies particularly affected due to the anticipated 15% tariff on those products. A European Commission spokesperson confirmed that the EU is still negotiating for an exemption on alcoholic beverages. The CAC 40 dropped -1.14%, the DAX -0.81%, while the FTSE 100 outperformed slightly, down just -0.05%, supported by strong earnings from Rolls Royce (+8.50%).

Asian equity markets, along with US futures, are experiencing a decline this morning following the imposition of new tariffs by the US on numerous trading partners. The KOSPI (-3.23%) stands out as the largest underperformer, trading sharply lower in response to the new Finance Ministry’s proposal to increase capital gains tax (more details below). Meanwhile, Chinese stocks are relatively stable, with the Hang Seng (-0.18%), the CSI (-0.16%), and the Shanghai Composite (-0.12%) all registering minor losses after experiencing significant declines in the previous session. Additionally, the Nikkei (-0.38%) and the S&P/ASX 200 (-0.75%) are also declining in unison with their regional counterparts.

Returning to South Korea, the new government has announced an increase in the corporate tax rate from 24% to 25%, with all corporate tax brackets rising by one percentage point. Furthermore, the stock transaction tax will be raised from 0.15% to 2%. The threshold for capital gains tax on stock holdings will be reduced to 1 billion won from the current 5 billion won. These measures are intended to recover public revenue lost during two years of slowing growth and tax reductions implemented by the previous administration. As you can imagine the proposals are not proving popular amongst market participants.

Early morning data revealed that China’s manufacturing sector unexpectedly contracted in July, as a decline in export orders and weak domestic demand took their toll. The S&P Global China Manufacturing PMI dropped to 49.5 in July (compared to +50.2 expected), down from 50.4 in June. In other news, Japan’s jobless rate remained unchanged in June at 2.5%, while the jobs-to-applicants ratio fell to 1.22 (versus +1.25 expected) from 1.24 in May.

Looking ahead, today’s US data releases include the July jobs report, the ISM index, total vehicle sales, and June construction spending. We’ll also see Italy’s July manufacturing PMI, the Eurozone’s July PMI, and Canada’s July manufacturing PMI. On the earnings front, reports are expected from Exxon Mobil, Chevron, Moderna, Nintendo, and AXA.

Tyler Durden

Fri, 08/01/2025 – 08:21

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://zerohedge.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.