By Taxpayers Association of Oregon

OregonWatchdog.com

Here is a Hoover Institution article that explains that the dire predictions of the 2017 Tax cuts from the Congressional Budget Office turned out to be wildly wrong. The optimistic forecasters even saw their predictions exceeded by reality as tax revenue came flooding into Federal coffers as a result of cutting taxes. This effects how Oregon is projecting the impact of the 2025 Trump tax cuts. Forecasters leave out the impact of a growing economy from tax cuts.

Hoover Institution explains:

“When the 2017 Tax Cuts and Jobs Act was passed, we were criticized for being overly optimistic about the effects we predicted it would have. Now the evidence is in. Our critics were wrong, and the economic data have met or even exceeded our predictions. In 2017, we predicted that reducing the federal corporate tax rate to 21% from 35% and introducing full expensing of new-equipment investment would boost productivity-enhancing business investment by 9%. Though growth in business investment had been slowing in the years leading up to 2017, after tax reform it surged. By the end of 2019 it was 9.4% above its pre-2017 trend, exactly in line with the prediction of our models. Looking solely at corporate businesses—those most directly affected by business-tax reform in 2017—real investment was up by as much as 14.2% over the pre-2017 trend, slightly more than we expected. Among S&P 500 companies, total capital expenditures in the two years after tax reform were 20% higher than in the two years prior, when capital expenditures actually declined.

Citing an extensive empirical literature, we also predicted that by enhancing worker bargaining power and increasing new investment in domestic plant and equipment, the average household would see real income gains of $4,000 over three to five years. In 2018 and 2019 real median household income in the U.S. rose by $5,000—a bigger increase in only two years than in the entire eight years of the preceding recovery combined. In 2019 alone, real median household income rose by $4,400, more than in the eight years from 2010 through 2017 combined….

Commentators have recently noticed that in the 2021 fiscal year, not only did federal corporate tax revenues come in at a record high, but corporate tax revenue as a share of the U.S. economy rose to its highest level since 2015. Actual corporate tax revenue in 2021 was $46 billion higher than the Congressional Budget Office’s post-reform forecast. Even though the U.S. economy was only slightly larger in 2021 than the CBO had projected, corporate tax revenue as a share of gross domestic product was 21% higher (1.7% versus 1.4%).”

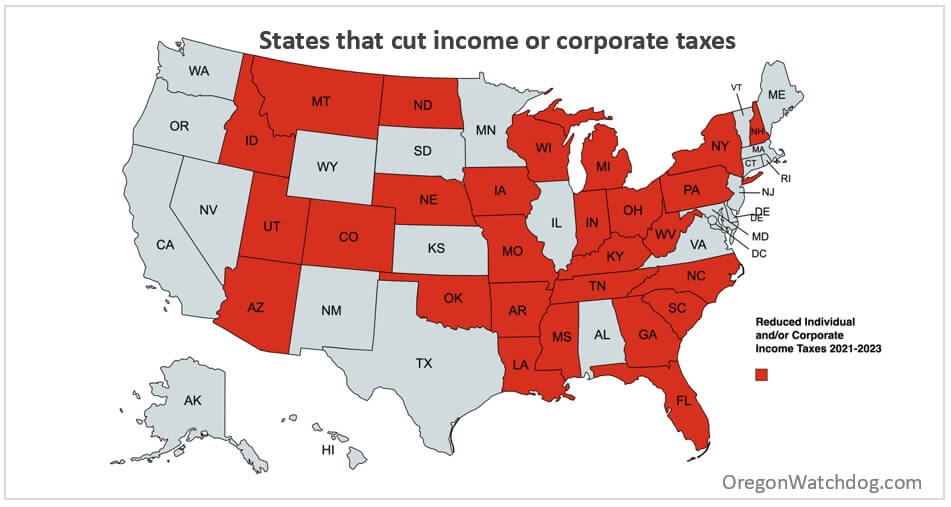

There is a lot going into the Oregon forecast, and much of it will be correct, but it is incomplete without including the power of cutting taxes to grow the economy. The power of cutting taxes will be negated in Oregon if it continues to raise taxes and fees by the billions and it continues to over-regulate while other states cut taxes and cut regulations.

Also, remember, the Federal government will be providing less funds to the states.

It turns out that America cannot afford every president to give out $7 trillion in “new” spending.

When President Trump makes cuts, he is doing it to make our government go on a diet and better pay down the $36 trillion debt.

Was this helpful? Contribute online at OregonWatchdog.com (learn about a Charitable Tax Deduction or Political Tax Credit options to promote liberty).

The post Oregon tax cut forecast may be wrong (like 2017) first appeared on Oregon Catalyst.

Click this link for the original source of this article.

Author: In the news

This content is courtesy of, and owned and copyrighted by, https://oregoncatalyst.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.