Gold prices refused to budge much last week, with the LBMA Gold Price PM settling Friday at $3,344 per ounce—just 0.3 percent below the prior close. That leaves the metal up a dazzling 28.6 percent year-to-date, still among 2025’s best-performing assets despite a flurry of trade headlines and political theatrics. Early gains driven by tariff jitters and President Trump’s very public sparring match with Federal Reserve Chair Jerome Powell fizzled after the president insisted there is “no tension” with the Fed and unveiled several new trade agreements. Even so, bullion’s resilience underscores lingering doubts about policy stability and the sustainability of the risk-on mood sweeping equities.

Speculative interest continues to creep higher. COMEX net-long futures contracts expanded, and global gold-backed ETF tonnage ticked up, signaling steady institutional demand, while options traders pared exposure ahead of the Fed’s July 29–30 meeting. Technicians now peg first support at $3,330–3,310 and first resistance at $3,451; a decisive break either way could push prices toward $3,132 on the downside or reopen the path to $3,500 on the upside. Monday’s $32 intraday swing to $3,338 confirmed the metal’s current sideways channel—and reminded investors that volatility can re-emerge quickly when headlines turn sour.

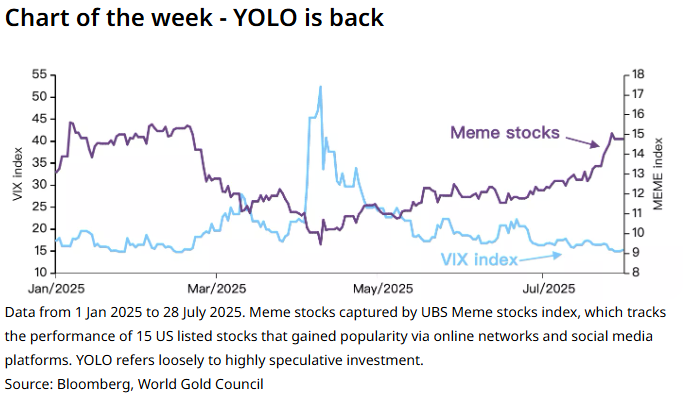

Across broader markets, optimism is bordering on exuberance. U.S. stocks rallied on robust second-quarter earnings—83 percent of S&P 500 companies have beaten estimates by an average 7 percent—and a UBS gauge of 15 “meme” favorites has gone vertical. The VIX volatility index, meanwhile, slid to multiyear lows, prompting the World Gold Council to warn of “equity euphoria” that could snap back violently. Yields on the 10-year Treasury slipped and the dollar softened, classic telltales of investors quietly hedging their bullish equity bets. In that context, gold’s quiet consolidation feels less like fatigue and more like a coiled spring for those wary of asset bubbles fueled by easy money.

Trade developments remain a wild card. Washington struck separate pacts with Japan, the European Union, Indonesia, and the Philippines; both the EU and Japanese deals slap a 15 percent tariff on most goods entering the United States, though Tokyo sweetened the pot with a promised $550 billion investment in U.S. projects. Negotiators are also expected to extend the U.S.–China tariff pause ahead of fresh talks in Stockholm. While markets cheered the flurry of signatures, history suggests that tariff truces can unravel quickly, and gold tends to benefit whenever negotiations wobble.

Monetary policy offers little clarity. The European Central Bank left its key rate unchanged at 2 percent after eight consecutive cuts, while U.S. housing data flashed mixed signals—existing-home sales fell 2.7 percent in June even as new-home sales eked out a 0.6 percent rise. Most analysts expect the Fed to stand pat this week given firm payroll and inflation numbers, though President Trump’s loud calls for rate cuts linger in the background. Should policymakers cave to political pressure—or merely hint at future accommodation—the case for sound, non-inflatable money only strengthens.

For now, bullion sits in a tight range, waiting for either the Fed or trade talks to provide direction. With equities stretched, volatility subdued, and tariffs still a tweet away from escalation, gold’s longstanding role as an all-weather hedge looks anything but obsolete.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Click this link for the original source of this article.

Author: Quoth the Raven

This content is courtesy of, and owned and copyrighted by, https://quoththeraven.substack.com feed and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.