Weaker than expected job gains combined with rising unemployment rates and massively negative revisions have sent rate-cut odds soaring with September now priced around 75%…

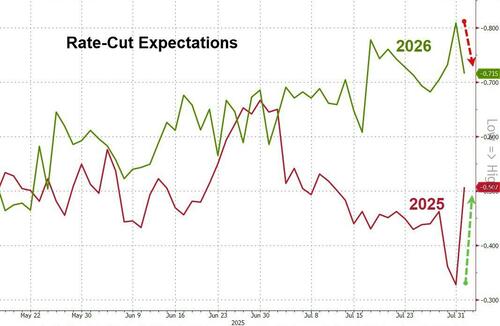

2025 cut expectations are now back above 50bps (and 2026 is fading modestly)…

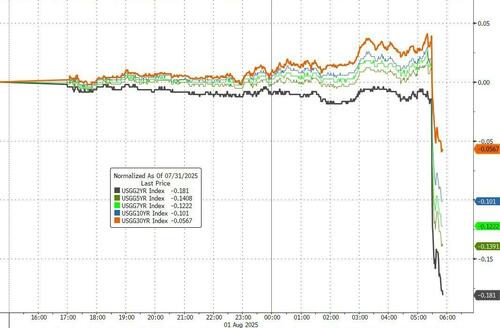

This has helped smash Treasury yields lower with the short-end leading (down a stunning 18bps)…

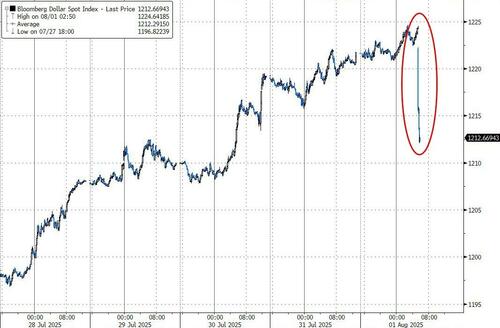

And the dollar is puking…

Gold is mirroring the dollar weakness and soaring higher…

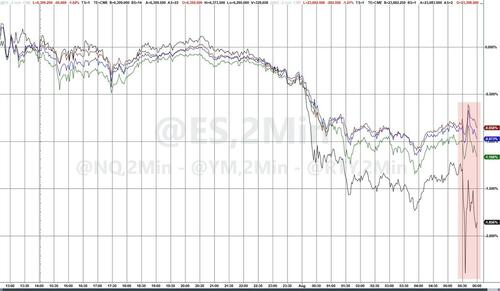

Stocks are lower post-payrolls but were notably weaker already on the heels of tariffs and AMZN disappointment…

So, circling back to the start, is this ‘bad news’ from the labor market, good news for Trump as it forces The Fed’s hand sooner rather than later?

Time for an emergency cut?

Tyler Durden

Fri, 08/01/2025 – 08:56

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://zerohedge.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.

.jpg?itok=LL_r8vNf)