Guest Post by Peter Reagan

A leading research firm says gold could climb to $5,500 by 2030 – and that’s their conservative estimate. We break down the global money supply explosion, strange Swiss gold moves and hints Russia plans to target silver price in a quiet war on the West…

Your News to Know rounds up the most important stories about precious metals and the overall economy. This week, we’ll cover:

- Research firm calls for $4,000 base-case gold price…

- …with $5,500 by the decade’s end a given based on inflation alone

- Swiss gold exports show that the COMEX gold squeeze runs deep

- Is Russia secretly supporting silver price?

WisdomTree: Gold will hit $4,000 minimum ($5,500 is likely as anything)

WisdomTree’s latest analysis, which discusses bitcoin as well as the price of gold, features a familiar three-path model. The three paths? Deflation, status quo and inflation.

Right at the top, you know what’s keeping these analysts up at night:

“With inflation proving to be sticky, sovereign debt burdens escalating, and trust in institutions coming under scrutiny, investors are reassessing the role that hard assets play in protecting and preserving long-term purchasing power. Gold has historically fulfilled this role, serving as a reserve asset and inflation hedge across centuries… This analysis presents a data-driven, scenario-based framework to explore how continued expansion of global money supply could shape the future valuation of ‘hard money’ assets…”

Right – that’s just the introduction!

Before we move on, let me tell you that WisdomTree is an international financial services provider headquartered in New York, with offices in Mexico, Central and South America, Europe and Israel. They manage a portfolio of $130 billion. I’m telling you all this for two reasons:

- Their research and analysis has a global perspective

- While they’re a big company, they aren’t a global conglomerate with an obligation to spout the status quo

That means, when they say things like the following, I pay attention:

“The historical trajectory of global money supply reveals a pattern of exponential growth. Based on aggregates from the world’s major economies, including the United States, Eurozone, China, Japan, the United Kingdom, Brazil, and India, the total money supply has expanded from less than $1 trillion in 1970 to approximately $180 trillion in 2025.”

Now, over the exact same 55-year period, global GDP grew from $11 trillion to $110 trillion.

I crunched the numbers. Here’s the compound annual growth rate (CAGR):

- Global money supply: +10.8% per year

- Global GDP: +5.8% per year

No wonder prices keep going up!

Okay, back to the WisdomTree analysis. They outlined three core cases.

The deflationary case, which considers a “return to a path of fiscal discipline” from governments and central banks alike? I think it’s pretty safe to dismiss it out of hand. There has been absolutely nothing to suggest any major government intends to impose austerity.

The deflationary forecast for gold is $3,000/oz.

Moving on to the base case, the analysis describes a continuation of current trends:

“…mild but persistent inflation around central bank targets, moderate real GDP9 growth, and a steady expansion of global liquidity. This path closely tracks the historical average global money supply growth of the past 50 years.”

Honestly, this sounds like a decidedly optimistic view on how the global economy could fare over the next five years. They predict $4,000 gold by 2030, and extrapolate to $9,000 by 2050.

Then we get to the really interesting part of the report. Probably the most likely outcome – the inflationary case:

“…accelerating monetary expansion amid unresolved fiscal stress, rising debt burdens, and the political appeal of inflation as a hidden tax on debt. In this regime, investor demand for non-sovereign stores of value rises as investor confidence erodes.”

Sound familiar?

These factors (which I believe we’re much closer to than the status quo described above), will send gold to $5,500 by 2030. That’s just five years away.

Extrapolate to 2050? $19,000/oz gold.

Now, let me ask: Which prediction sounds the most likely to you?

Are governments suddenly going to start spending responsibly? Will central banks stop enabling them?

If your answer is “no” to both, you should buy gold right now. Because today’s price looks like an absolute bargain compared to $5,500 – let alone $19,000 by mid-century.

$19,000 gold sound too high? That’s about 4.5x today’s gold price in 25 years.

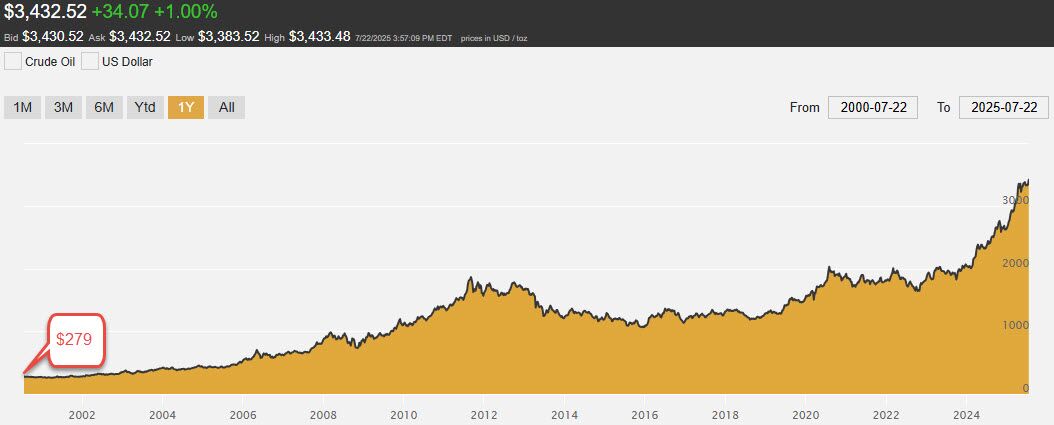

So let’s look 25 years backward:

That’s right – the price of gold has risen 11.3x over the last 25 years. From $279 in July 2000 to today’s $3,400.

Now, I wasn’t working in the industry back in 2000 – but, if I was, and I told you, “Gold’s price is going up 11x over the next 25 years,” you probably would’ve laughed in my face. If I told you the global money supply was going to rise at 10.8% per year, same response.

If that 10.8% annual growth number sounds familiar, that’s because gold’s price grew on average at the same rate as the global money supply!

That’s what I call a safe haven, inflation-resistant asset.

Swiss gold exports hit six-year highs – what’s going on?

This April report says COMEX gold warehouses were emptying out, and all the Swiss gold imported to beat the Liberation Day tariffs has gone back to Switzerland. (I’ve been wondering where the gold was going – COMEX stockpiles are down about 15% from their March record highs.

Now, the same outlet tells us that Swiss gold exports jumped 44% in June to the highest level since 2019 – “as bullion flew back to the vaults in the United Kingdom from the United States via Swiss refineries.”

How incredibly strange…

First, it’s interesting to see that the report makes a distinction between Swiss exports to the U.S. and to the UK. Remember when I filled you in on the Bank of England’s inability to deliver physical gold “because there was a lorry in the bullion yard… And the stuff is also quite heavy”?

What a joke.

This looks like a continuation of the Swiss refinery-Bank of England vaulting-COMEX warehousing fiasco from earlier this year. When the Bank of England went through a run on their vaults so severe they had to institute a months-long wait for delivery, despite their promised 14-day settlement window.

But that’s all over now – because the Liberation Day tariffs exempted bullion.

So why are we still seeing stories about massive, unexpected global gold movements?

A few plausible explanations come to mind… Honestly, though, all I have is speculation.

It could be massive institutional short covering. Could be Basel III. Or part of a broader global trend of institutional gold reallocation.

Regardless, this continues to be a story to watch.

And the bottom line is simple. Hundreds of tons of gold are being shipped to vaults around the world – and probably not because its owners feel safe and confident in the current state of the global economy.

Is Russia boosting silver prices with secret, massive purchases?

I’ve been downplaying the gains in silver’s price recently. (The reasonable consensus is that $40 and then $50 are the next real targets.)

True, silver climbed to a 14-year high, notching an impressive 30% increase since January.

But why?

Yes, it’s a big price move. But it’s nowhere near a fair price considering the gold-to-silver ratio, the growing supply deficit or industrial demand.

So when silver finally starts its long-delayed move up, I expect it’ll hit the $50 level – not $39.

Something else seems to be driving prices up. Analysts have pegged Russia as the likely culprit. Russia already announced in 2024 that it would spend $535.5 million on precious metals in the next three years, and silver was conspicuously included.

This was notable for many reasons. Not least that central banks haven’t really held silver reserves for nearly a century.

The silver standard was officially abandoned in 1870, at least here in the U.S. While both gold and silver are now considered forms of sound money, central banks are buying gold alone like it’s the 19th century.

Willem Middelkoop, founder of Commodity Discovery Fund, claims:

“Russia will also be aware silver is manipulated through the COMEX futures, and I wouldn’t be surprised there is a monetary aspect as well (putting pressure on the paper silver system).”

Listen: If you believe, as many do, that silver is the most heavily-shorted asset in the world with a price most disconnected from reality? Then Russia’s decision to stockpile physical silver is nothing less than an attack on both COMEX and London’s “daily fix” silver price.

Why? COMEX “open interest” can be 100x larger than the actual registered physical silver in warehouses. And London’s daily “fix” set via large trades among a handful of banks, not physical settlement. And all this works just fine as a paper-shuffling shell game.

The game depends on liquidity, though. And buying up physical silver is the smartest, least traceable, and most systemic way to attack commodities markets.

I’m calling this an “attack” for a reason. Don’t forget, back in October Anton Siluanov, (head of the Russian Ministry of Finance) announced the BRICS Precious Metals Exchange:

“The creation of a mechanism for trading metals within the BRICS countries will lead to the formation of fair and equitable competition based on exchange principles. The mechanism will include the creation of instruments for price indicators for metals, standards for the production and trade of bullion, accreditation of market participants, clearing and auditing within the BRICS countries, and the participating countries will have a reliable way of stable exchange trading within the association.”

Siluanov wants the BRICS Precious Metals Exchange to “become a key regulator of prices for precious metals.”

What’s the best way to become a key regulator of precious metals prices? Well, all you have to do is expose your competitors as frauds and cheats. Then, you sit back and watch the entire market self-destruct. Let the dust settle. Step in and pick up the pieces.

With an annual supply deficit of 215.3 million ounces and rising, silver is arguably the tightest global commodity. The worst positioned to handle demands for physical settlement (a 100:1 leverage ratio, remember?)

Two major takeaways here:

- BRICS could be gearing up for a form of “monetary guerilla warfare.” Planning the downfall of COMEX and London bullion markets by a thousand physical deliveries…

- If you’re already a silver owner, though, it’s well-positioned, as it means that price suppression mechanisms will weaken by necessity.

It’s interesting to think about, isn’t it? The suppression of silver’s price could be a point of weakness for BRICS nations to attack. Again, a story I’ll be watching closely.

Ever notice how prices keep climbing but your paycheck stays flat? That’s what happens when more dollars chase the same goods. A physical gold IRA lets you own real metal that holds its value even as the dollar weakens. You get all the tax perks of an IRA plus the security of tangible assets you can count on. Click below to grab your FREE Gold IRA info kit from Birch Gold Group and learn just how simple it is to add real metal to your retirement plan.

Click this link for the original source of this article.

Author: Administrator

This content is courtesy of, and owned and copyrighted by, https://www.theburningplatform.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.