After surging higher in May, on the back of huge Boeing aircraft orders, US durable goods orders were expected to tumble back to earth in preliminary June data… and they did.

Durable Goods Orders plunged 9.3% MoM (slightly better than the -10.7% MoM expected) – the biggest drop since the COVID lockdowns. But as the chart below shows, it is a wildly noisy time series, almost entirely due to the lumpiness of aircraft orders…

Source: Bloomberg

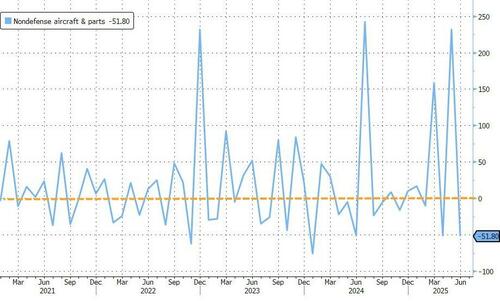

Thanks to a swing from a 230% MoM rise to a 50% MoM decline in non-defense aircraft orders…

Source: Bloomberg

Excluding the noise of Boeing orders, the data was actually solid with a 0.25% MoM increase (better than the 0.1% rise expected) in durable goods orders (ex-Transports), pushing YoY orders uo 2.23%

Source: Bloomberg

Adding to the confusion, the value of core capital goods orders, a proxy for investment in equipment excluding aircraft and military hardware, decreased 0.7% last month after an upwardly revised 2% gain in May

Capital goods shipments rose 0.4%, excluding defense and commercial aircraft, better than the +0.2% expected, adding to Q2 GDP growth hopes.

A very mixed picture from a generally considered ‘secondary’ economic indicator… and this the market reaction is muted to say the least.

Tyler Durden

Fri, 07/25/2025 – 08:44

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://zerohedge.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.