Authored by Lance Roberts via RealInvestmentAdvice.com,

Next week, the Q2-2025 earnings season will begin in earnest as a barrage of S&P 500 companies report, starting with the Wall Street money center banks on Tuesday and Wednesday. Since earnings drive the market by supporting investor expectations, what should investors expect? Let’s dig into the details.

Over the last few months, according to data from S&P Global, the Q2-2025 earnings estimates have declined from $234/share in the original March 2024 estimate to $220/share as of June 15th. That $14 drop in estimates is partially due to the impact of tariff concerns on corporate outlooks.

According to FactSet:

“Heading into the end of the quarter, analysts have reduced earnings estimates for S&P 500 companies for the second quarter more than average. However, the percentage of S&P 500 companies issuing negative earnings guidance for the second quarter is less than average. As a result, estimated earnings for the S&P 500 for the second quarter are lower today compared to expectations at the start of the quarter. In addition, the index is expected to report its lowest year-over-year earnings growth rate since Q4 2023 (4.0%).

In terms of estimate revisions for companies in the S&P 500, analysts have lowered earnings estimates for Q2 2025 by a larger margin than average. On a per-share basis, estimated earnings for the second quarter have decreased by 4.1% to date. This decline is larger than the 5-year average (-3.0%) and the 10-year average (-3.1%) for a quarter.”

Again, many of those negative revisions are tied to concerns over tariffs under the current Administration, and the lack of finalized “trade deals” keeps forward estimates in flux. However, as we move into Q3 and Q4 of this year, there should be sufficient resolutions to stabilize forecasts.

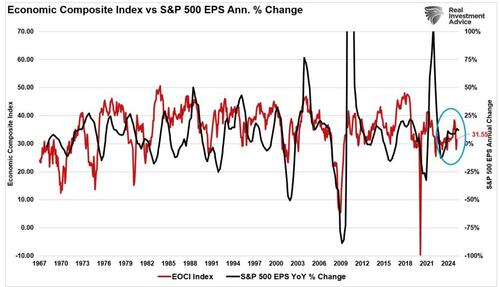

The macro-tailwinds of easing trade tensions, falling energy prices, and optimism over Fed rate cuts have helped equity markets return to new highs in June. However, some of those advances will be tested in the coming weeks, as there is a risk of earnings disappointment, particularly as we see continued weakness in the economic data. The Economic Composite Index (roughly 100 data points) has decreased sharply in the last two months. Historically, earnings track real economic activity, suggesting a risk of disappointment exists.

Why Estimates Are Being Cut More Sharply

There are three core drivers to explain the steeper-than-normal downward revisions in Q2-2025 earnings.

Rising trade risks: Trump’s tariff actions renewed mid‑year jitters. Industry groups and strategists at Goldman, Bank of America, and Citi warn tariffs may shave off ~1–2% EPS growth per 5pp increase in effective duty rates. While tariffs are on pause, that “pause” expires July 7th. We fully expect that pause to be extended into Q3, given the Administration has deals currently in progress. However, investors should potentially hedge against unforeseen problems later in the summer.

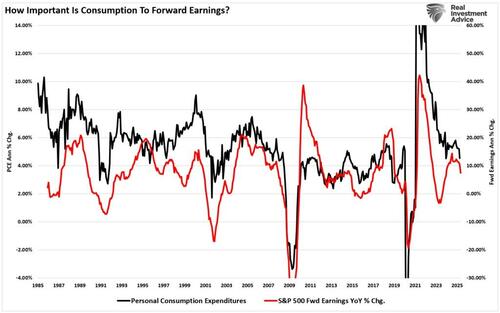

Weaker consumer spending: Our most significant concern for Q2-2025 earnings and the rest of the year is slowing economic growth, which will spill over into consumer spending. As discussed in “Consumer Spending Drives Earnings,” there is a high correlation between Personal Consumption Expenditures (PCE) and earnings. To wit:

“One of the better measures for developing a framework for future earnings growth is personal consumption expenditures (PCE), since they comprise nearly 70% of the economic equation. The annual percentage change in forward earnings tracks the yearly percentage change in PCE fairly closely.”

Given the recent softness in the employment data and the downturn in PCE, the risk to earnings is rising.

Lastly, the downturn in energy and materials earnings directly reflects economic weakness. The Q2-2025 earnings for the energy sector declined by ~19%, while materials fell by ~12% year‑over‑year. The decline in those two sectors is essential given their reflection of economic activity.

However, on the optimistic side, the Technology and Communications companies (particularly given their weight in the index) are buoying corporate earnings. Ongoing strong investment in AI and capex, particularly within the “Magnificent 7,” is expected to report strong earnings and revenue growth. As such, their Q2 guidance and commentary will likely offset some of the risk of spillover from trade and consumer dynamics.

Positioning For Earnings Season

At RIA Advisors, here is how we are positioning ahead of Q2 earnings reports.

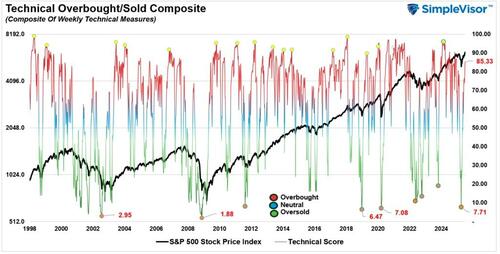

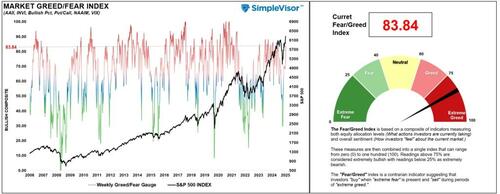

After the strong run in asset markets from the April lows, markets are technically back to more overbought levels, with sentiment returning to “extreme greed.” Those levels open the door to a higher level of “disappointment” in earnings announcements than would otherwise be the case.

As such, we are looking to rebalance portfolio risk by reducing risk in areas with the highest degree of “disappointment potential” and somewhat raising cash levels. This gives us a hedge against downside risk, and cash to buy earnings “over reactions” in structurally advantaged sectors.

Our primary focus will be to:

(The following is not a recommendation or solicitation to buy or sell any securities. This is strictly for educations and informational purposes only and a disclosure of RIA’s positioning.)

-

Focus on structurally advantaged sectors: Stick with AI heavyweights like Microsoft, Nvidia, and Alphabet. They carry forward earnings momentum, and guidance around AI spending could prompt positive sentiment . Conversely, avoid high-beta cyclical stocks, which may underperform if tariffs spark volatility.

-

Tilt toward defensive, dividend‑paying stocks: As equity valuations remain elevated, despite slowing economic forecasts, adding exposure to low‑volatility and dividend‑generating segments, like consumer staples or utilities, can add ballast. Our primary portfolio includes companies like PG, BRK.B, RTX, and V.

-

Watch guidance tone, not just numbers: Companies may retract or express uncertainty. Last quarter, ~4% of S&P 500 firms withdrew forward EPS commentary due to tariff uncertainty. In Q2 calls, examine the economic forecast from cyclical, discretionary, and staple companies for warnings or downward momentum beyond base estimates.

-

Expect upside surprises, but remain realistic: Historically, 75–77% of S&P 500 firms top EPS expectations, due to the deep cuts of estimates going into earnings season. However, with consensus estimates already cut deeply, there is a high potential for a higher-than-normal “beat rate,” especially in tech (MSFT, NVDA), healthcare (ABBV, LLY), and communications (META, GOOG).

-

Retain domestic vs. international exposure: The powerhouse of earnings growth remains the U.S. versus the rest of the world. With Central Banks cutting rates globally to offset sluggish economic growth, the backdrop of U.S. earnings will remain attractive to investors globally. This is why the U.S. has massively outperformed international markets over the last 15 years, and it is unlikely to change soon, given the dominance of AI by U.S. companies.

Conclusion

Q2-2025 earnings season reflects a more cautious narrative: earnings growth is decelerating, estimates have been cut more sharply, and company guidance is likely to follow suit. Yet underlying fundamentals remain solid, especially in the technology, communication, and defensive segments. Historically, positive surprises tend to outpace negativity, offering upside potential if macro headwinds remain stable.

However, our primary concern remains the slowing growth trend in the economic data. That trend, combined with rising delinquency rates, rising defaults, and declining consumption, all suggest that monetary policy is too restrictive and the Federal Reserve is likely behind on cutting rates. As discussed recently:

“This raises the danger of a policy mismatch: If the Fed waits for inflation that doesn’t arrive, it may keep real interest rates excessively high for too long, just as it kept them too low following the pandemic. The consequences could be severe.”

Next week, as earnings season kicks into high gear, investors should emphasize quality, weigh defensive income options, remain alert to guidance tone, and consider hedged exposure in reports. A well‑balanced approach, with a tilt toward AI‑led growth balanced with conservative positioning, will align risk/reward ahead of potentially market-moving announcements.

Trade accordingly.

Tyler Durden

Sat, 07/12/2025 – 10:30

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://zerohedge.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.