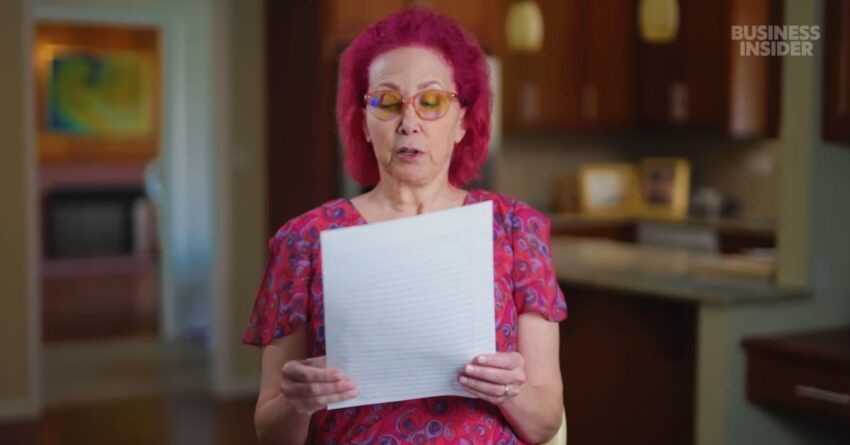

When early retiree Misty Miller turned in her retirement paperwork at 58, she thought she had it all figured out, with more than $500,000 in savings, plus a guaranteed $3,000 monthly pension. Furthermore, her mortgage was paid off, and her monthly expenses were down to just $800. Overall, the math seemed to guarantee years of financial security after her retirement. However, Knewz.com has learned that her “dream retirement” soon clashed with reality, and within a few years, most of her savings was gone.

A Recipe for Disaster

Miller stepped away from her job in 2016, imagining a leisurely life of relaxation, travel and personal freedom. However, she had not planned for the empty schedule that came with retirement, and she quickly realized that her work gave her a sense of purpose and daily structure. “I hadn’t really planned it out. I had enough money, that was the part I planned out, but I hadn’t planned out what I was going to do all day, and that was the problem. … I had no important decisions to make and no social network anymore.” The early retiree added, “All I could think of is that I made the biggest mistake of my life. Work was my social connection, and I lost that by retiring early. … Work gave me purpose. Now my most important decision was: What should I have for breakfast?”

A Rash Decision Cost Miller A Lot, Literally

Within a week of retiring, Miller found herself calling her former employer, asking for her job back. However, the company responded that her role had already been removed from the company’s organizational chart. “I felt so sad, so depressed. I couldn’t believe my office wouldn’t take me back,” she said. Hoping to lift her spirits, her husband suggested a short trip to the beach. Instead, Miller made a rash decision and bought a house there, paying for it by cashing out her entire 401(k). The financial impact was devastating. With a 45% tax penalty, she lost nearly half of her retirement savings overnight. “To this day, I cannot explain,” she said. “I lost my mind.”

The Beach House Disaster

Miller sold her Sacramento home and moved into the beach house, but retiring there was nothing like what she had hoped. Bored, she took a job at a local newspaper, making $19 an hour. But even that did not last, as she never felt settled and eventually left the newspaper job. Eventually, Miller returned to Sacramento and bought a new home outright with the little money she had left. “I was unemployed essentially, so nobody was going to give me a loan if I was unemployed,” she said. On the other hand, with the beach house unsold, her pension alone could not cover her bills. She dipped into a dwindling money market account to make up the difference. “She was cash poor, living month-to-month,” reports mentioned. She got back on the job market, only to face ageism. Miller finally got a full-time job in 2023 with a California state agency employer. She was 63 at the time.

Miller’s Advice: ‘Never Retire’

Miller is currently 65, making $8,650 a month and has no plans to fully retire anytime soon. She has also rebuilt her retirement savings up to $450,000. Although she is eyeing partial retirement in the future, for instance, working 40% of the time while collecting a portion of her pension, a complete retirement is not on her radar. And that is precisely what she advises the younger generation: “My advice to the younger generation is: Don’t ever retire. Keep your job. … I look forward to going to work every day. People say they have to go to work, I say I get to go to work.”

The post Lessons From Retiree Who Blew Through $500K Savings appeared first on Knewz.

Click this link for the original source of this article.

Author: Samyarup Chowdhury

This content is courtesy of, and owned and copyrighted by, https://knewz.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.