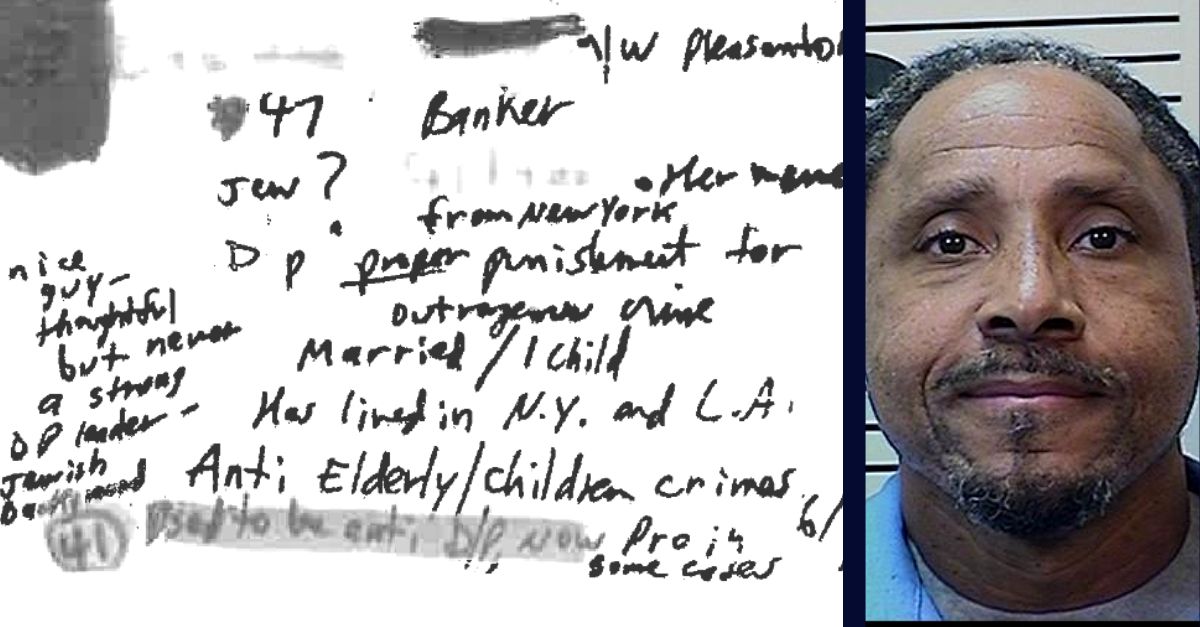

Handwritten notes plotting alleged removal of Black, Jewish jurors unearthed, throwing active death penalty cases spanning 40 years into jeopardy: DA

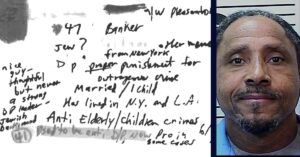

Handwritten jury notes unearthed by a staffer at the Alameda County District Attorney’s Office (ACDA) in California revealed a strategy of excluding Jewish and Black jurors from the pool of Ernest Edward Dykes, pictured right in booking photo provided by the