By Jan Nieuwenhuijs of Gainesville Coins

Recently the World Bank released a handbook for asset managers on why to invest in gold. At Gainesville Coins I have written numerous articles on gold revaluation accounts and how these can be deployed by central banks to absorb losses in case of emergency. The World Bank has taken notice of my research as they allude to this practice in a chapter on reserve accounting and reference to my work.

The World Bank publication underlines the fact that gold is the only financial asset without counterparty risk, and due to its scarcity relative to fiat currencies its price in the long run always increases. Central banks that own gold for an extended period can reap the benefits of their gold revaluation account without having to sell any gold.

Introduction

The Gold Investing Handbook for Asset Managers document published earlier this year by the World Bank Treasury is an interesting read for investors. It covers the gold market structure, optimal portfolio assessments, geopolitical aspects, a trading and liquidity guide, and a discussion on gold accounting, among other subjects.

The World Bank Treasury is tasked to manage the World Bank’s finances and contribute to the Bank’s twin goals of “ending extreme poverty and promoting shared prosperity.” As such it acts as a trusted advisor to its member countries to support financial stability and provide “thought leadership in the broader treasury and financial management arena.” With this mission in mind the Bank’s Treasury writes that:

Throughout history, gold has played a vital role as a financial asset in the global financial system. … In the modern era, gold continues to play a critical role in the global financial system, serving as a hedge against inflation, a safe haven asset, and a reserve asset for central banks. … The role of gold in the global financial system has evolved over time, with changes in monetary policy, economic conditions, and technological advancements influencing demand and supply dynamics. Despite these changes, gold remains a crucial component of the global financial system and is likely to continue to play an essential role in the future. … The market disruptions brought about by the 2008 Global Financial Crisis (GFC), the US and China trade war, Brexit, and the COVID-19 pandemic, as well as a prolonged period of negative real interest rates and geopolitical uncertainties caused by financial sanctions imposed on Russia to freeze its foreign reserves, reinforced the strategic importance of gold as a buffer against financial instability.

Central Bank Gold Revaluation Accounts

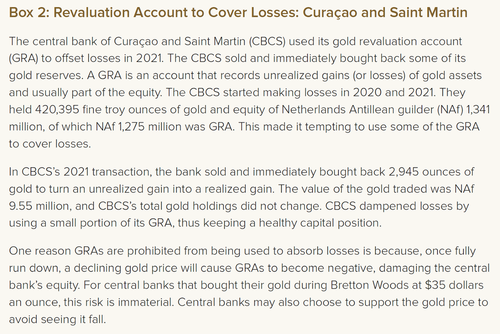

After the central banks of advanced economies such as the Netherlands and Germany stated their gold revaluation accounts (GRAs) guarantee their solvency in 2013, the World Bank now joins the discussion on GRAs. On page 57 of its report there is a summary of my article on how the central bank of Curaçao and Saint Martin utilized its GRA to cover losses in 2021.

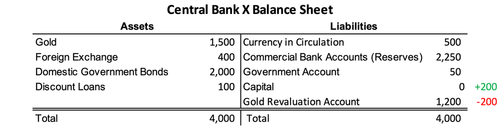

Simplified, a GRA is an accounting entry on the liability side of a central bank’s balance sheet that records unrealized gains in gold. Because central banks are the root of the modern money tree, they can use these entries to pay for expenses. A GRA, if sufficient, can prevent a central bank from going into negative capital in times of financial stress without having to sell gold (for more details read my article here).

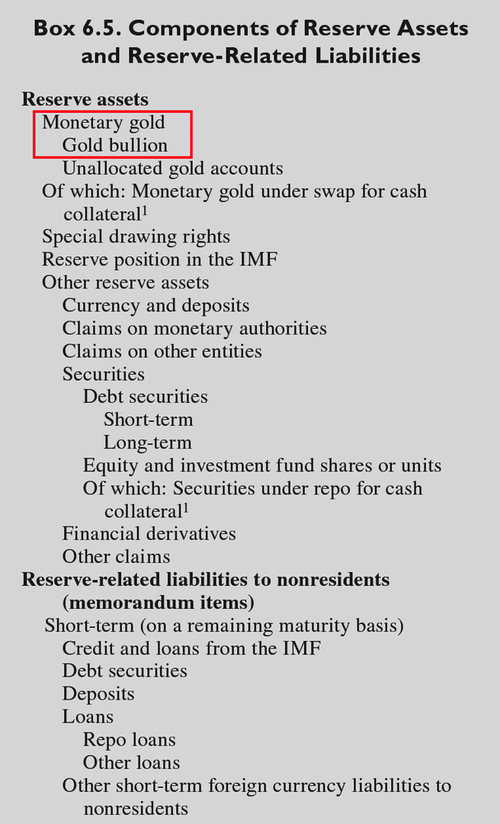

All in all, the World Bank’s reporting of GRAs is bullish for gold as it once again confirms gold’s position front and center in the monetary system. Gold—as per International Monetary Fund (IMF), the World Bank’s sister institute—is the only universally accepted financial asset that is not someone else’s liability. From the IMF (BPM6):

Financial assets are economic assets that are financial instruments. Financial assets include financial claims and, by convention, monetary gold held in the form of gold bullion … A financial claim is a financial instrument that has a counterpart liability. Gold bullion is not a claim and does not have a corresponding liability. It is treated as a financial asset, however, because of its special role as a means of financial exchange in international payments by monetary authorities and as a reserve asset held by monetary authorities.

Gold has no counterparty risk and can’t be arbitrarily devalued. Hence, the IMF lists gold at the very top of reserve assets, which makes gold the hardest asset for central banks to own and creates significant unrealized gains over time through the debasement of the currency they issue. And as I have explained previously these unrealized gains can be turned into realized gains to pay for expenses.

Conclusion

In the past years more and more central banks from both the global South and North—and international financial institutions like the World Bank—are pitching gold as an imperative asset with multiple functions. Gold is a safe haven asset, inflation hedge, backup currency, its revaluation accounts can be used, etcetera.

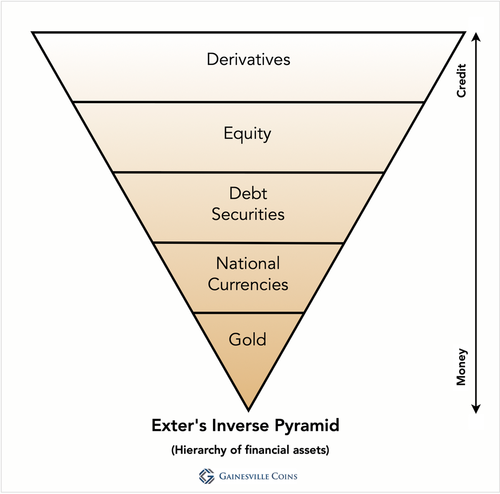

If one looks at the order of the IMF’s list of reserve assets the similarities with Exter’s inverse pyramid is easily seen. Gold truly underpins the global financial system. In my view, though, the value of all financial assets resting on gold has grown too large in the past decades. For stabilizing the pyramid (financial system), the value of the gold needs to increase accordingly.

But we will explore these imbalances more in depth in my next article.

Further Reading

- German Central Bank Doesn’t Rule Out Gold Revaluation

- Governor Dutch Central Bank States Gold Revaluation Account Is Solvency Backstop

- How a Central Bank in the Caribbean Recently Used Its Gold Revaluation Account to Cover Losses

- German Central Bank: Gold Revaluation Account Underlines Soundness of Balance Sheet

- How Central Banks Can Use Gold Revaluation Accounts in Times of Financial Stress

Tyler Durden

Thu, 04/18/2024 – 18:20

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://zerohedge.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.