Are you prepared to secure your future against Central Bank, Digital Currency (CBDC) and digital dollar tyranny?

The Dossier has teamed up with

It’s Tax Day, which, for most Americans, means it’s time to fork over lots of cash to the feds.

Unless you’re running Pfizer, which is paying a grand total of zero dollars and zero cents in taxes this year. In fact, Pfizer is expecting a hefty refund!

Despite bringing in $58 billion in revenue and billions in net income for 2023, Pfizer is not paying a dime in taxes. Thanks to their scale, size, and taxpayer-funded support system, Pfizer and its peers reap tax benefits that allow for the zeroing out of their tax burden. Such privileges are not afforded to Main Street businesses, highlighting an incredibly unequal tax code that benefits mega corporations at the expense of the average citizen and small businesses.

The news is especially unsavory for American taxpayers, considering the fact that Pfizer’s income over the course of the Covid era was produced via the American and overseas taxpayers themselves. Taxpayers subsidized the research and development, approval process, purchasing, and implementation of Pfizer’s junk mRNA product line. The mRNA shots, coupled with the failed Paxlovid oral pill, gave Pfizer an unprecedented windfall, delivering tens of billions in annual profits.

Over the years, Pfizer has produced an incredibly extensive overseas tax shelter apparatus, one that includes hundreds of subsidiaries, which exist in over sixty different countries. For many years, Pfizer — like many of its Fortune 100 peers — has offshored virtually all of its profits, effectively zeroing out its tax burden. Although the company is headquartered in New York, Pfizer’s army of attorneys, accounts, and the like make sure to reorient their losses into the United States, while linking their profits to known tax shelter havens like Switzerland, Ireland, the British Virgin Islands, and Singapore.

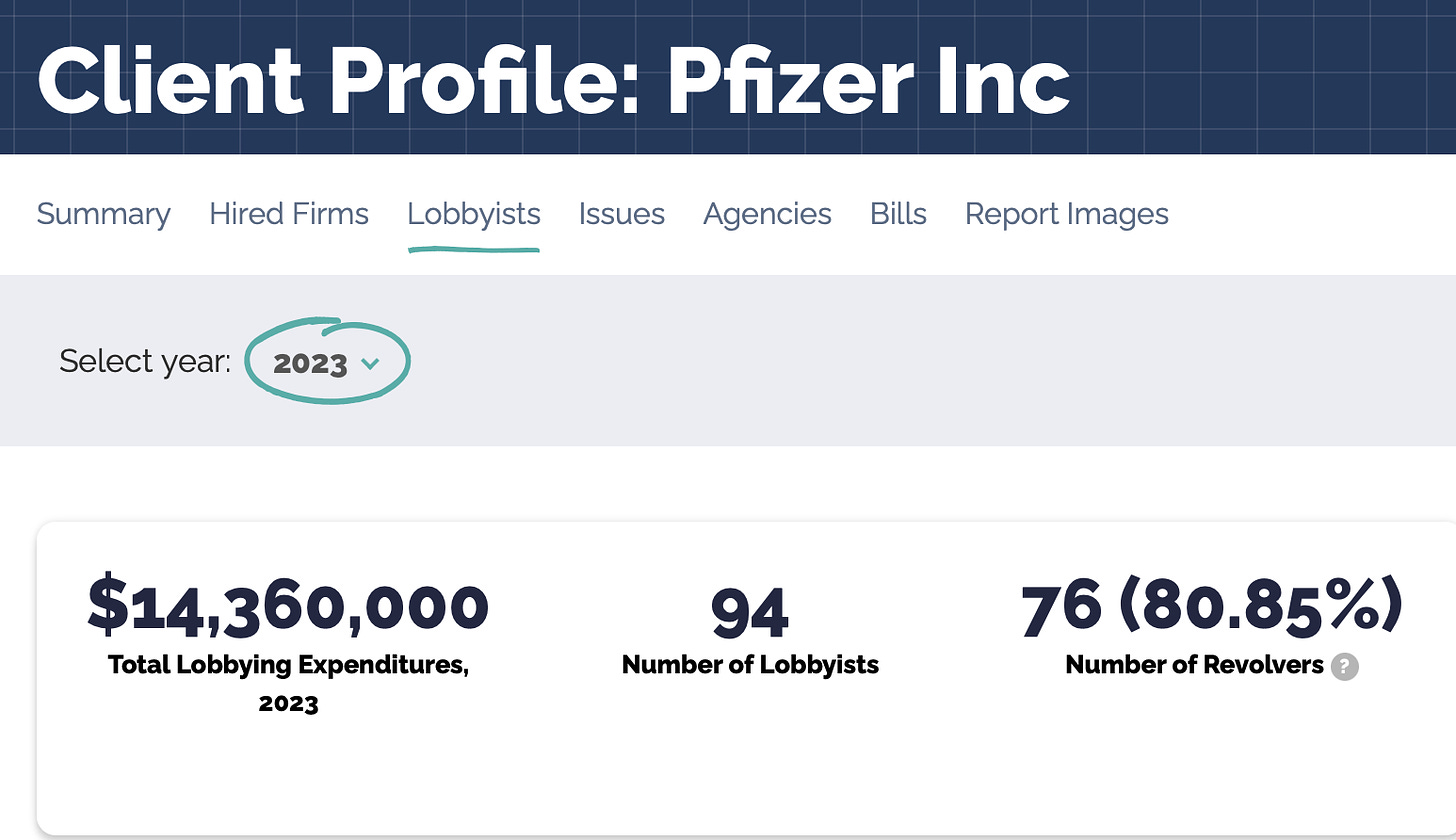

And every year, Pfizer alone spends tens of millions of dollars lobbying legislators to manipulate the tax code to their benefit.

Last year, the pharmaceutical industry as a whole spent over $381 million to employ 1,851 lobbyists in Washington, D.C. And that work has paid major dividends for the mRNA giants

Yet time and again, President Biden has made it a point to declare that his administration has pushed back against the interests of the pharmaceutical lobby, which spends more money lobbying in Washington, D.C. than any other industry.

In one such 2022 rally, President Biden screamed into the microphone, “we beat Pharma this year! We beat Pharma this year! And it mattered. We’re gonna change people’s lives.”

During his State of The Union address last month, Biden declared, “we finally beat Big Pharma … I also want to end the tax breaks for Big Pharma, Big Oil, private jets, and massive executive pay!”

Given Pfizer’s zero dollar tax burden, it sure doesn’t seem like Biden “beat Pharma” after all.