If you’re just getting started in the world of trading or using cryptocurrency, chances are you’ve heard of Ethereum (CRYPTO:ETH). Whether you’re looking to use it, invest in it, or just want to experiment with digital cryptocurrency based on recommendations from friends, colleagues, or internet personalities, your first questions probably revolve around where to buy it and how to get started.

As with anything to do with digital assets, investing with real money, and online security, safety should be your number one priority. Taking care to invest your money with trustworthy and reputable institutions should be the final result of a long process of research and analysis. Don’t blindly follow the recommendation of the tech bro in your office or an attractive influencer.

If, at the end of that process, you have made the decision to invest in Ethereum on eToro, we have all the information you need to get started along with all you should know about the entire process. Here is how to buy Ethereum on eToro, step by step.

What is eToro?

eToro is an Israeli digital-first online investment company best known for its social-trading platform of the same name. eToro launched its first app, the eToro OpenBook social investment platform in 2010 which was available on smartphones and featured a sleek, clean, and simple design that made investments and stock trades much easier and more accessible to newcomers.

The most iconic features that earned eToro ongoing notoriety were its CopyTrader feature and trading community. CopyTrader allows any user to copy the trades of other traders and investors in real-time. If you have a favorite financial personality whom you want to imitate, CopyTrader allows you to do so. eToro’s trading community feature allows all users to share their trading activity and follow the activity of all other users. You can collaborate and compare trades with other like-minded investors as you make trades. You can learn how to purchase assets on eToro here.

eToro does not hold or sell any stocks of its own and does not hold users’ funds. It is a trading platform allowing access to world markets and all funds are deposited in reputable banks.

Since its launch, eToro has expanded around the world and into trading cryptocurrency (along with the Etoro Wallet for storing and managing digital assets), options with the new eToro Options app, and more. See the differences between crypto platforms like Coinbase (NASDAQ:COIN) and eToro in our comparison article.

What is Ethereum?

Ethereum is actually the name of the decentralized blockchain and smart contract platform that produces and enables the cryptocurrency Ether (abbreviated as ETH online). On trading platforms and digital wallets, the two have become synonymous and it is not uncommon to see Ether listed as Ethereum in many places. Only the truly obsessed cryptocurrency fanatics will correct you on the difference.

Ethereum is an open-source software platform that allows anybody in the world to create decentralized applications and was launched in 2015. Its most widespread and famous use is for decentralized finance, allowing users to conduct financial transactions without relying on brokers, exchanges, or banks. Ethereum has expanded into NFTs and many other digital currencies rely on Ethereum for their own validation and launch.

The actual science behind Ethereum and Ether is something best left to a more in-depth article or analysis. We encourage you to conduct this research yourself if you truly want to understand the digital currency you have chosen to invest in.

Ether is among the most valuable and popular cryptocurrencies in the world, usually coming in second behind Bitcoin (CRYPTO:BTC).

How to Buy Ethereum on eToro

For this guide, we will assume that you do not yet have an account with eToro. If you do, you can skip to the part where we walk through the actual purchasing process.

eToro is available on smartphones and internet browsers. While you don’t necessarily need a smartphone to use eToro, it is highly recommended to take advantage of the mobile-friendly interface and digital-first design.

Creating an account is easy, however you should check to make sure eToro is available where you live, and that Ether is available to buy on the app in your area. eToro is not allowed to operate everywhere and is not available in every state in the United States. It would be unfortunate to set up your account and transfer starting funds only to realize you can’t purchase Ether after all. We encourage you to research what is available in your area before starting.

You will need to verify your address and identity and connect your bank account to fully activate your account.

Once your account is set up, you can buy and sell any of the available cryptocurrencies available on eToro just as you would any other stock or asset. Before you begin, however, you will need to decide which type of Ethereum (Ether) you will want to purchase. On the eToro cryptocurrency platform, there are a handful of Ethereum assets you can invest in: Ethereum, Ethereum Classic (CRYPTO:ETC), Ethereum Name Service (CRYPTO:ENS), and currency tracking pairs.

Which one should you choose? Well, that’s up to you.

Ether, (commonly referred to as Ethereum), is the primary cryptoasset associated with the Ethereum network. While the Ethereum platform hosts thousands of assets and enables many different functionalities and currencies, the primary coin of the entire network is the Ether coin.

Ethereum Classic was launched in 2016 after a division in the Ethereum community migrated the main network toward more Proof-of-Work applications. There are several differences between the two cryptocurrencies, including the fact that the number of Ethereum Classic assets is limited to just 210 million coins.

Ethereum Name Service is another Ethereum network project offering services for blockchain wallets, websites, and much more. The number of Ethereum Name Service tokens is limited to just 100 million.

There are many more differences between all the Ethereum assets available to purchase, all of which are beyond the scope of this article. If you want to learn more, here is a plethora to learn about each. Chances are, though, if someone recommends you buy Ether (or Ethereum) they are referring to the primary cryptoasset. We recommend you do your research if you are unsure.

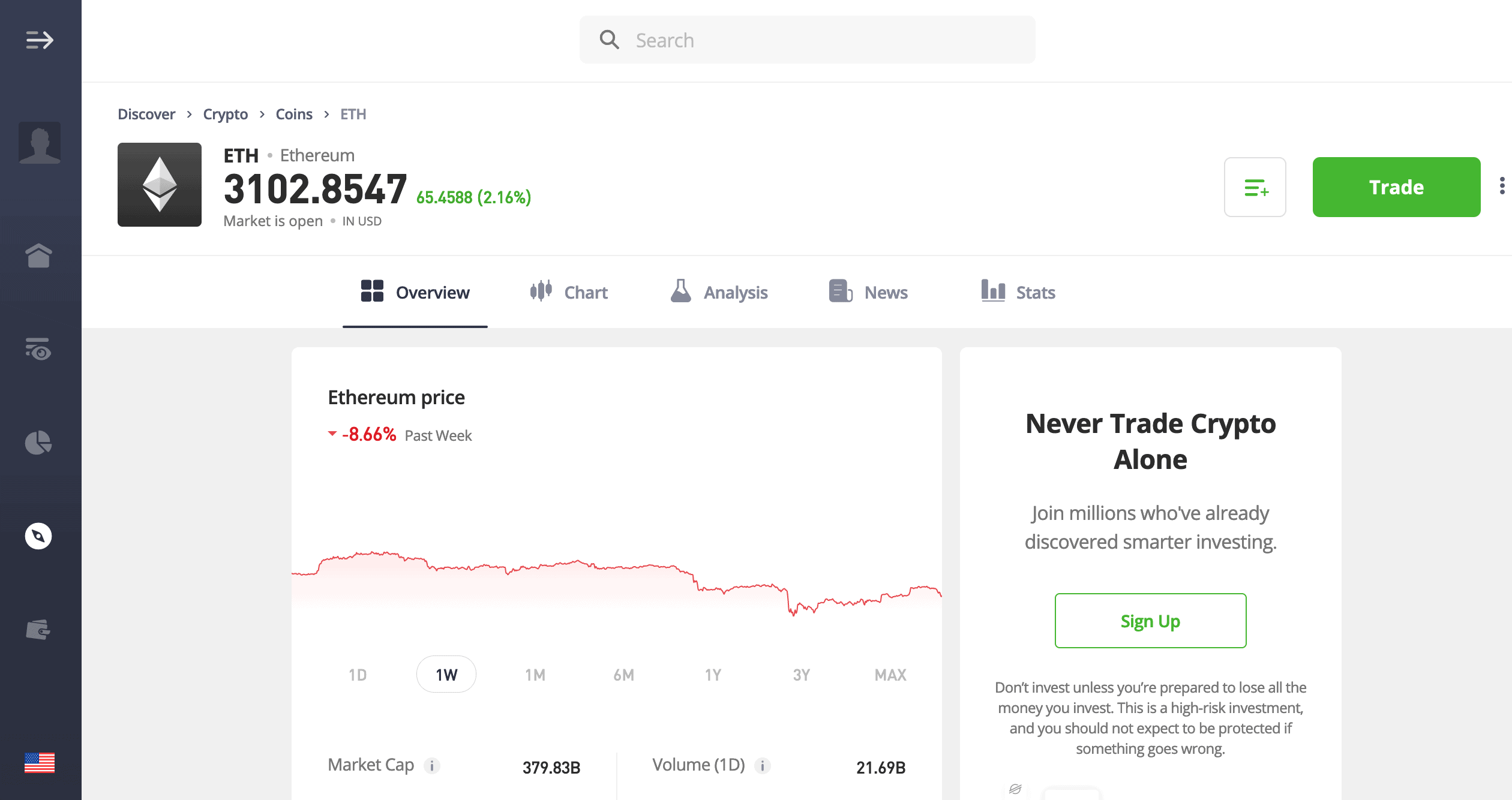

Once you are ready, in the app or on the website you will need to navigate to the crypto page and find Ethereum (or Ether) or simply type in the name in the search bar. You can type in the cryptocurrency abbreviation of ETH to achieve this.

Once you are on the Ethereum hub page, you can choose to Trade or make an Order. Trading is the typical way to purchase an asset, allowing you to buy it at the current market price. Setting an Order allows you to set a price that will tell eToro to automatically purchase the asset once its value matches that price.

You will have a choice of how many Ether to purchase. Once you complete the purchase, the number of assets you purchased will appear in your account. That’s it! We recommend downloading the eToro Crypto Wallet to safely store and manage your cryptocurrency. You can read more about the eToro wallet here.

If you’re curious about any other part of eToro’s products and services, check out this page: a regularly updated list of all our eToro guides, news coverage, and lists of benefits.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

The post How To Buy Ethereum On eToro, Step By Step appeared first on 24/7 Wall St..

Click this link for the original source of this article.

Author: Aaron Webber

This content is courtesy of, and owned and copyrighted by, https://247wallst.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.