Guest Post by Peter Reagan

Central banks are buying gold like never before. Russia just nationalized a major gold miner, Tether launched a “digital gold” token while billionaires are doubling down on bullion. The message is clear: Owning gold is no longer optional…

Your News to Know rounds up the most important stories about precious metals and the overall economy. This week, we’ll cover:

- Gold is the latest must-have for central bankers and pro investors…

- …why are so many everyday investors still not catching on?

- Russia nationalizes its 3rd-biggest gold mining company (why?)

- The popularity of so-called “tokenized gold,” and why bullion is better

Fourth consecutive year of 1,000+ ton central bank gold buying?

It’s starting to look like world central banks will buy over 1,000 tons of gold again. For the fourth consecutive year. For context, globally central banks own as much gold today as they did in 1968 – during the heyday of the Bretton-Woods gold standard era.

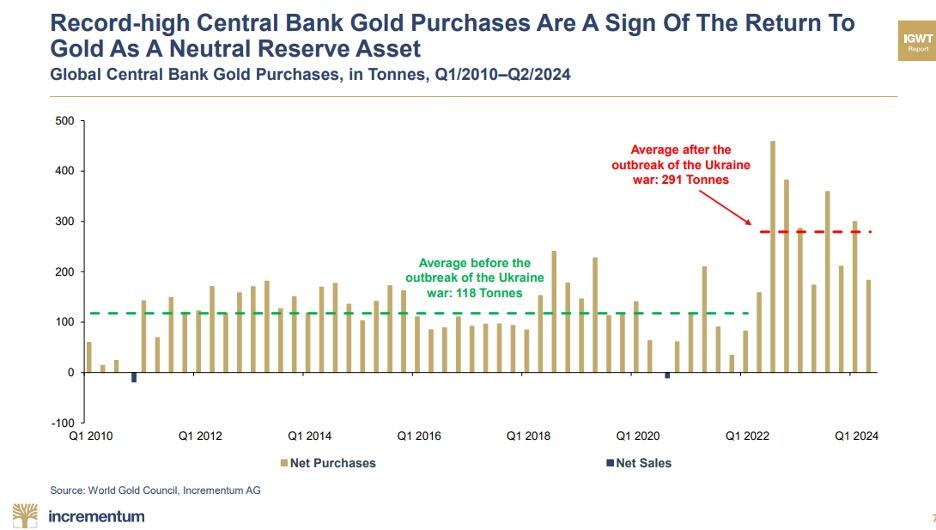

Why? The primary explanation is that Biden’s weaponization of the dollar against Russia triggered the surge in purchasing. This graphic from Incrementum is fairly compelling on its own:

While I don’t disagree that dollar weaponization played a role, I think it was more of a tipping point (or perhaps an excuse?) rather than the primary motivation.

Latest data shows that 95% of central bank respondents in a recent World Gold Council survey expect to increase their gold exposure over the next 12 months. That is an absolutely massive percentage that can’t be blamed on the weaponization of the U.S. dollar alone.

The dollar has always been weaponized! Journalist Saleha Mohsin is explains this very well. I mean, the U.S. has sanctioned Cuba and Iran for decades. But the real weaponization efforts began in 2001, after the 9/11 attacks on the World Trade Center and the Pentagon. Biden’s efforts were just the latest step in a long journey of dollar weaponization.

Was that the straw that broke the proverbial camel’s back?

Possibly.

Regardless, dollar weaponization is virtually an American tradition today. Every other nation knows what’s going to happen if they launch an invasion or a coup. Russia learned this firsthand back in 2014, when they invaded and annexed Crimea away from Ukraine. That round of sanctions hurt Russia – so in preparation for Phase 2 of Operation Capture Ukraine, Russia’s central bank loaded up on gold.

This gold-buying was obviously a bid to shield the nation from Western sanctions. And it’s worked pretty well! Despite three years of complete banishment from the global financial system, Russia exported more energy to China and India last month than ever before. Russia’s GDP growth outperformed the U.S. in the first quarter of the year.

What’s the lesson here? Simple – in a world where the U.S. has veto power over every financial transaction worldwide, gold cannot be weaponized.

Dollars, once the preferred reserve asset of central bankers everywhere, are no longer their first choice.

Look at the chart again. Since Biden’s 2022 weaponization, central bank gold buying has risen 2-3x.

Again, though it’s not just dollar weaponization at work here. For instance, Poland and Hungary’s central banks don’t buy gold because they’re worried about U.S. sanctions.

Something much deeper is happening. And it’s discussed openly a lot more often than you might expect.

These nations are looking to accumulate real money while printing currencies they obviously know are worthless for their citizens to amuse themselves with. I’ve said it before and I’ll say it again:

If central bankers, the people who make and control currencies, don’t trust currencies, then why should we?

Here’s the thing. Central banks are not buying gold because they plan to issue a new and improved form of intrinsically valuable gold or silver money. No, because that would mean sharing part of their precious metals reserves with citizens. With everyday people like you and me. They’ve already decided never to do that again – not since Switzerland took the last gold coin out of circulation back in 1949.

Consider for a moment just how dramatically standards of living have eroded since then. How much purchasing power has crashed since 1949. How much more a home, or a car (or for that matter an ounce of gold) costs today…

Okay, let’s move on – what does this voracious central bank demand mean for gold prices?

Dominic Frisby solidly doubts we will ever see a $2,000 gold price again – hard agree. Frisby squints at some charts and concludes that we’ll see a breakout soon, with a new floor at $3,500 (as it now appears that $3,300 is the floor). And quite a number of analysts agree – many naming $4,000 as the next milestone in the gold bull market.

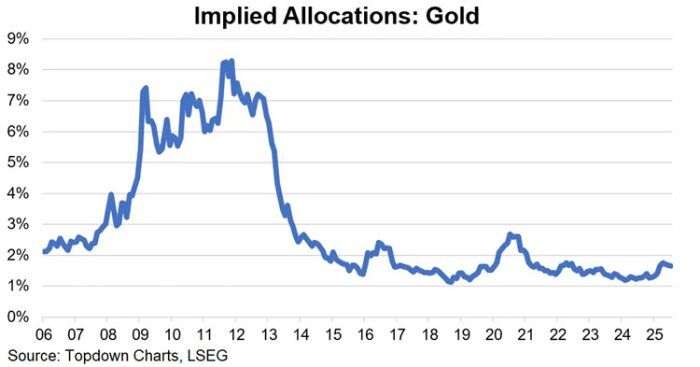

Frisby believes that a well-diversified portfolio means owning more than a tiny sliver of physical precious metals. He’s far from alone! The Financial Times’s Asset Allocator show spoke to professional investment managers on this topic.

The broad consensus? A single-digit percentage allocated to gold is simply insufficient. As 71M’s Ben Kumar said, “When we invest in something, we want to invest in a meaningful way.”

Investing guru Dr. William Bernstein has a suggestion. In his excellent The Four Pillars of Investing, he emphasizes that for an asset class to meaningfully contribute to your diversification and risk-return profile, it should constitute at least 10% of the total. Any less, and you’ve got “noise” – more complexity, without significant benefits.

Today, right now, American investors have, on average, an insignificant allocation to gold.

Guess who knows this? Rich people, as the HSBC Investor Snapshot reported a few days ago. Gold allocations among the wealthy more than doubled compared to last year…

The days of physical precious metals, of gold and silver as so-called “alternative assets” has passed.

Central banks know it! Three and a half consecutive years of record gold-buying.

The wealthy know it! They’ve more than doubled their gold allocation over the last year.

Professional investment managers know it! They argue about how much gold and silver you need to be truly diversified, but you know what they don’t argue? Whether or not you need it! Because they understand that everyone needs to diversify

I’m concerned about everyone else.

Central bankers, rich people and professional investors are all looking out for themselves – who’s looking out for you? Who’s making sure that you’ve not only diversified your savings with the one single asset that everyone else agrees you must have, but that you’re allocating a sufficient percentage of your savings?

I still believe that’s your decision to make. Freedom ain’t free –you’re free to make your own decisions, but you are not free from the consequences of those decisions.

I respectfully suggest you choose wisely. (And soon.)

China and Russia may each have a 20-30,000 ton gold hoard?

Russia has seized $50 billion in private assets since the start of the Ukraine invasion. For context, $50 billion is about what the corporations FedEx or AFLAC are worth – not chump change.

Yet the recent nationalization of the country’s third-largest gold producer Yuzhuralzoloto (South Ural Gold) is actually the biggest theft by the state so far.

What does “nationalization” mean here? Well, it means that billionaire and regional lawmaker Konstantin Strukov, Russia’s 78th richest man, used to be the owner of record. Now, the government of the Russian Federation owns the company.

Which also means that the company can be run for the sole benefit of the Russian government. In other words, it can mine however much it pleases (even ignoring environmental and safety laws enforced by the government) directly into Russia’s central bank vault. How much gold? About 12-14 metric tons (386,000-450,000 troy oz.) per year – mined, refined and stockpiled, ingot by ingot, in the vaults of the Банк России.

We’ve often discussed how and why China’s central bank and government probably owns about 20,000 tons of gold. It’s a puzzle that completely overshadows the case of Russia, which could own as much as 10,000 or more tons of gold.

So how do these unofficial, unreported gold reserves work? In both instances, there’s a network of gold miners and refiners that’s owned by, or operating on behalf of, the government.

Now, these claims of massive, secret off-book gold reserves might sound nuts. Unless you’re elbow-deep in the inner workings of the global gold market, it’s easy to accept that both Russia’s and China’s gold reserves are about 2,300 tons each. Because that’s what they officially report.

Why keep gold reserves secret? Why under-report official holdings? Well, there are a number of reasons…

- Strategic ambiguity: A country with hidden reserves can hedge against dollar dependency and threaten monetary sovereignty – without triggering immediate retaliation or market consequences.

- Shielded war-chest: In a sanctions-heavy world, official gold reserves are targets. Undeclared reserves, stored outside the Bank of International Settlements system, outside foreign bank oversight or in off-book state entities, is harder to freeze or trace.

- Forex market leverage: A large, hidden gold reserve gives a country hidden strength to deploy, in a currency crisis or dedollarization push – allowing a nation to catch currency markets off-guard.

- Supporting domestic industry: A government quietly absorbing all domestic gold production obviously supports mining and refining industries, without pressuring prices.

- Diplomatic wild card: During closed-door BRICS meetings, nations might hint at (or even share) these hidden reserves, as a way of strengthening their negotiating positions.

Remember, the U.S. dollar’s dominance is based, in part, on the world’s largest official central bank gold reserve of 8,133 metric tons. If in fact the U.S. gold reserve is not the world’s largest, well, that’s not good news for the dollar.

Tokenized gold explodes even amid scrutiny as investors try to find shelter

Crypto stablecoin Tether has done well and exceeded expectations on many fronts. It managed to sidestep most accusations of inadequate reserves and survived while many stablecoins crumbled, mostly holding its U.S. dollar peg to this day. In fact, Tether seems to be the largest non-state owner of U.S. federal government debt right now. In fact, recent Congressional legislation seems focused on promoting stablecoins to create new customers for the exploding U.S. debt!

Tether dominates dollar-pegged stablecoins – so can they dominate the digital gold market as well? Tokenized gold, or “crypto gold,” is now one of the most popular alternatives to gold bullion, with $19 billion of annual volume.

Tether’s gold custodian Cantor Fitzgerald is planning to back yet another product involving “digital gold” supposedly backed by gold bullion, a project with an initial financing goal of $1.1 billion. Tether already claims to own an 80-ton gold stockpile ($8 billion, or 5% of its $112 billion portfolio).

And then Tether launched its digital gold token, XAU₮ – “like gold, but easier,” the ads say. Each token is more divisible than inconvenient physical gold bullion, offering increments as small as 0.000001 troy oz. That’s one millionth of a troy oz, 0.03 milligrams – a quantity so incredibly tiny you can buy three of them for a single penny. Just enough gold to be mistaken for a grain of pollen, if you have your reading glasses on…

While Tether does offer physical redemption of its gold token, there are of course caveats. They must be redeemed in troy oz. quantities that match whatever gold bars Tether has lying around in its Swiss vault. Then “the company will arrange for [the gold bar’s] secure transit to the delivery address in Switzerland specified by you.” And there’s a fee, of course, but that’s less of an issue than setting up a post office box in Switzerland – or arranging an international flight to claim your gold bar.

But none of these details really addresses the underlying problem. Digital gold is not gold. “Digital gold” in the form of a token, a promise to pay or anything other than physical gold itself is not gold. Rather, it’s a financial instrument that allows traders to speculate on the price of gold.

Physical gold bullion has zero counterparty risk. Tether gold owners could wake up tomorrow to news that, whoops, Tether is bankrupt. When that happens, the promise of physical redeemability means absolutely nothing.

This is something that holders of physical gold in the forms of coins and bars simply don’t have to worry about. And this is the #1 reason that Birch Gold Group only works with physical gold and silver bullion, just about the only financial assets you can own outright. In your own name. No promises to pay, no trips to Switzerland required.

I care about this a lot. Gold is supposed to be the one asset nobody compromises on because it’s the one thing that holds up in times of crisis. I hate to see investors forgetting that only gold bullion is real gold. If you want to speculate on changes in gold price, feel free! There are loads of ways to do this – commodities futures, gold mining companies, gold loans and leases, even “digital gold.”

But please, please don’t mistake your speculation for investment. Don’t confuse IOUs, promises and contracts with physical gold bullion.

As central banks continue unprecedented money creation, protecting your purchasing power becomes critical for retirement security. Physical gold IRAs offer a tax-advantaged solution, allowing you to hold tangible precious metals with intrinsic value independent of currency fluctuations. To learn more about how physical gold could help protect your retirement portfolio, click here to get your FREE info kit on Gold IRAs from Birch Gold Group.

Click this link for the original source of this article.

Author: Administrator

This content is courtesy of, and owned and copyrighted by, https://www.theburningplatform.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.