Back in 2013, I debated Joe Biden’s top economist on the death tax. Everything I said then (and wrote four years before then) is still true today.

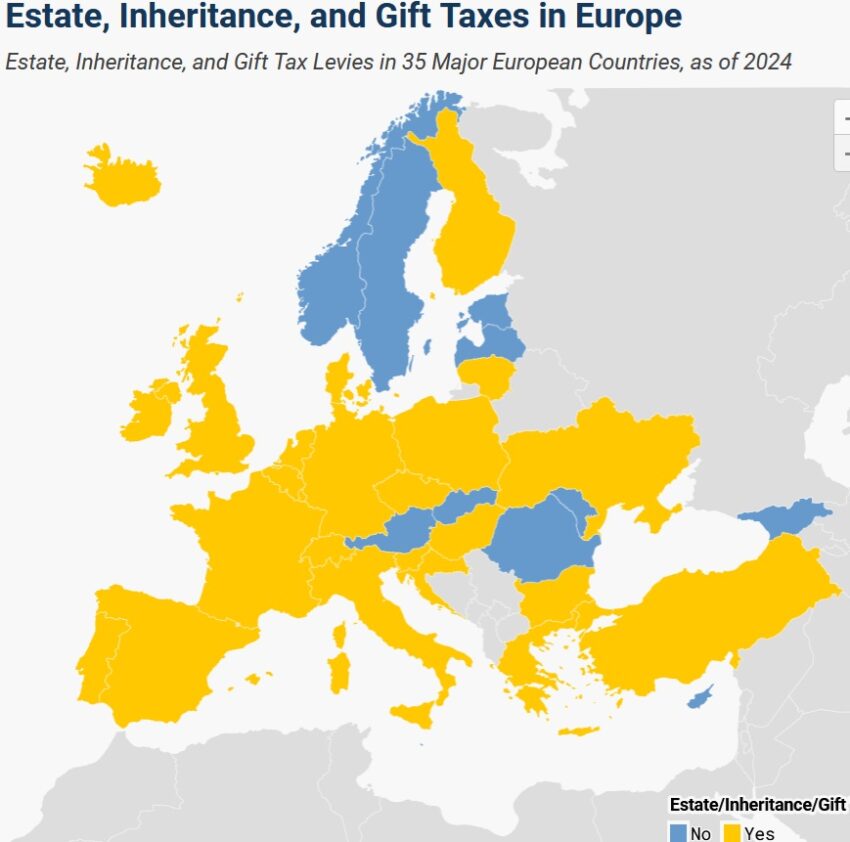

In the interview, I mentioned nations that have abolished their death taxes, including Australia.

I should have mentioned Sweden as well.

As a general rule, I don’t want to copy Swedish tax policy, but that nation wisely abolished its death tax (and also its wealth tax).

We should do the same thing in the United States.

There’s obviously a strong economic argument against the death tax since it exacerbates the problem of double taxation in the internal revenue code.

But I’m even more motivated by the moral argument against the death tax. Simply stated, it’s wrong to impose an extra layer of tax merely because someone has died.

Well, the good news is that the death tax will become less of a problem if Republicans enact the so-called One Big Beautiful Bill. Here are some excerpts from a report in the Washington Post by Jeff Stein.

Congressional Republicans are proposing to permanently allow wealthy families to pass on more of their assets tax-free, as the federal government all but abandons taxing large inheritances. …both the House and Senate versions would raise the exemption starting next year to $15 million for individuals and $30 million for couples, then set them to adjust for inflation in the future. …these changes are set to weaken an estate tax that already affects fewer households than it has in decades. …While the tax’s defenders say it is necessary to curb dynastic wealth at a time of rising inequality, conservatives have long argued the policy unfairly hits the same taxpayer twice because it taxes assets that were originally accumulated after their owners paid income taxes. …“It’s a tax on savings, and there’s a double-taxation issue — you earn the money, you paid taxes, and then the government comes after you again when you die,” said Michael Strain, an economist at the American Enterprise Institute.

While I like that the Republicans want to “weaken an estate tax,” it would be much better to fully repeal this awful levy.

That will upset advocates of class warfare. And it also will disappoint the tax planning industry, which collects big fees for helping families protect against the death tax.

But dying should not be a taxable event.

The only good thing about the death tax is that it creates all sorts of weird examples of how taxes affect behavior.

- Straight men will marry each other to escape the tax.

- Gay men will adopt their lovers to escape the tax.

- People will live longer to escape the tax.

- People will die earlier to escape the tax.

- People will adopt new identities to escape the tax.

But I’m willing to have fewer topics for my columns if we have better tax policy for the country.

P.S. Trump may have learned through personal experience that the death tax is bad. Hillary Clinton, by contrast, wanted others – but not herself – to pay the tax.

P.P.S. Bureaucrats at the Paris-based OECD don’t have to pay tax, yet they are pushing for higher death taxes in the US. Republicans need to cease all taxpayer handouts for those hypocrites.

Click this link for the original source of this article.

Author: Dan Mitchell

This content is courtesy of, and owned and copyrighted by, https://freedomandprosperity.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.