With Netflix shares trading near their highest valuations going back to 2022, there was a lot riding on the streaming giant’s earnings report tonight (and its outlook for the months ahead).

“Netflix shares are priced for perfection, there isn’t a lot of room for error,” said Daniel Morgan, senior portfolio manager at Synovus Trust Co.

“Everybody is expecting the second half to be really strong.”

And they didn’t disappoint with beats on the top- and bottom-line…

-

*NETFLIX 2Q EPS $7.19, EST. $7.08

-

*NETFLIX 2Q REV. $11.08B, EST. $11.06B

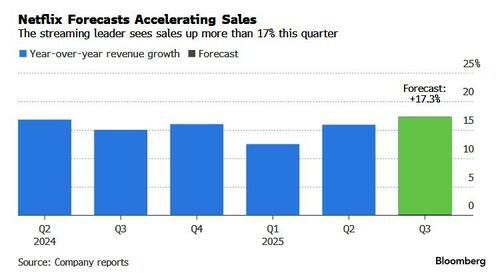

…and a higher guide too.

-

*NETFLIX SEES 3Q EPS $6.87, EST. $6.70

-

*NETFLIX SEES 3Q REV. $11.53B, EST. $11.28B

-

*NETFLIX SEES FY REV. $44.8B TO $45.2B, SAW $43.5B TO $44.5B

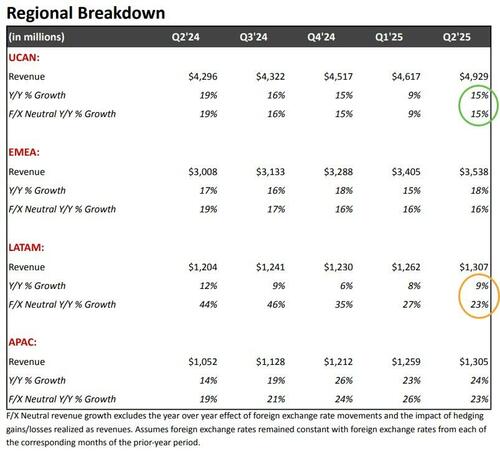

Regionally, growth was solid with notable FX impacts with decent domestic growth of 15%, buoyed by recent price increase. The company is trying to draw in customers with a lower-cost, advertising-supported offering in a dozen markets. Its advertising sales are expected to double this year.

In their earnings statement, Netflix stated that:

Our business continues to perform well.

In Q2, we grew revenue 16% and our operating margin of 34% expanded seven points year over year. Both revenue and operating income were slightly above our guidance due primarily to F/X, net of hedging, and the timing of expenses.

We’re optimistic heading into the second half of the year, with a standout slate that includes Wednesday S2, the Stranger Things finale, the highly anticipated Canelo-Crawford live boxing match, Adam Sandler’s Happy Gilmore 2, Kathryn Bigelow’s A House of Dynamite and Guillermo del Toro’s Frankenstein.

As we previewed earlier this was a very crowded long and so, despite the beat and raise, NFLX shares are down after hours (after briefly spiking higher)…

While investors used to judge Netflix by the number of subscribers it added in any given quarter, the company has stopped disclosing how many customers pay for its service, directing them to focus on more traditional metrics such as sales and profit.

Tyler Durden

Thu, 07/17/2025 – 16:17

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://zerohedge.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.