by Eldric Vero

April 11, 2024

This CotD was inspired by two recent articles:

1) The Expose News “A Message from Japan to the World – by Professor Masayasu Inoue” (see link: https://expose-news.com/2024/04/11/a-message-from-japan-to-the-world-by-professor-masayasu-inoue/ ). From the article: “My name is Masayasu Inoue, Professor Emeritus of Osaka City University Medical School. My specialty is Molecular Pathology and Medicine. The pandemic was used as a false pretext by the WHO to drive vaccinations of all peoples in the world. A plan was set up to shorten the time to develop vaccines, which usually takes longer than ten years to less than one year. Operation Warp Speed. This operation was used to cover up the misconceptions of the genetic vaccines. Under the pretext of saving time, an extremely dangerous method was selected. And the result was the induction of the terrible drug induced injury that has never seen in human history. I believe that the fraudulent use of experimental gene therapy to healthy people, particularly to healthy children, is an extreme violation of human rights. The Japanese government is first in the world to approve a new type of vaccine called self-replication replicon vaccine, and plans to start to supply it in this fall and winter.”

2) GlobalResearch “Video: Japanese Are Protesting Sudden Deaths From COVID-19 mRNA Vaccines” (see link: https://www.globalresearch.ca/video-japanese-protesting-sudden-deaths-covid-19-mrna-vaccines/5841617 ). A quote from this article “Clinic Director from Ginza, Tokyo shares his observation on his vaccinated patients (Turbo Cancer)… Then, we are seeing patients with conditions like giant cell diabetes or light cell leukemia — diseases that are very rare and not often encountered in clinical practice. The cardiovascular specialist told them that they had never seen such diseases before though he read about them in books. I’m still wondering why there are so many people like this.” (this was a repeat article worth posting again)

The author of the CotD has combined analyses of Covid-19 and Excess Deaths (all causes) as these are related. This is an update from the previous CotD of November 30, 2023.

Panel 1 The first graph is a construct by the author as a standard CotD presentation which illustrates Covid-19 related deaths (CRDs) and vaccinations. The Japan vaccination program began in March 2021 with little effect on the death rate until about October 2021 as the death rate subsided to a very low rate indicating the vaccine program “appeared” to be effective (over 90 percent of the Japanese population was fully vaccinated by then). The death rate increased dramatically in the first quarter of 2022 from less than 5 per day to 503 per day on January 15, 2023 (over 100-fold increase) which is unimaginable to say the least. Note the booster shot to death rate correlation since April 2022 as the curves are mirror images of each other. Also as an aside, the Japan Covid-19 data on the ourworldindata.org website has not been reported since May 2023 (this has not changed as of today).

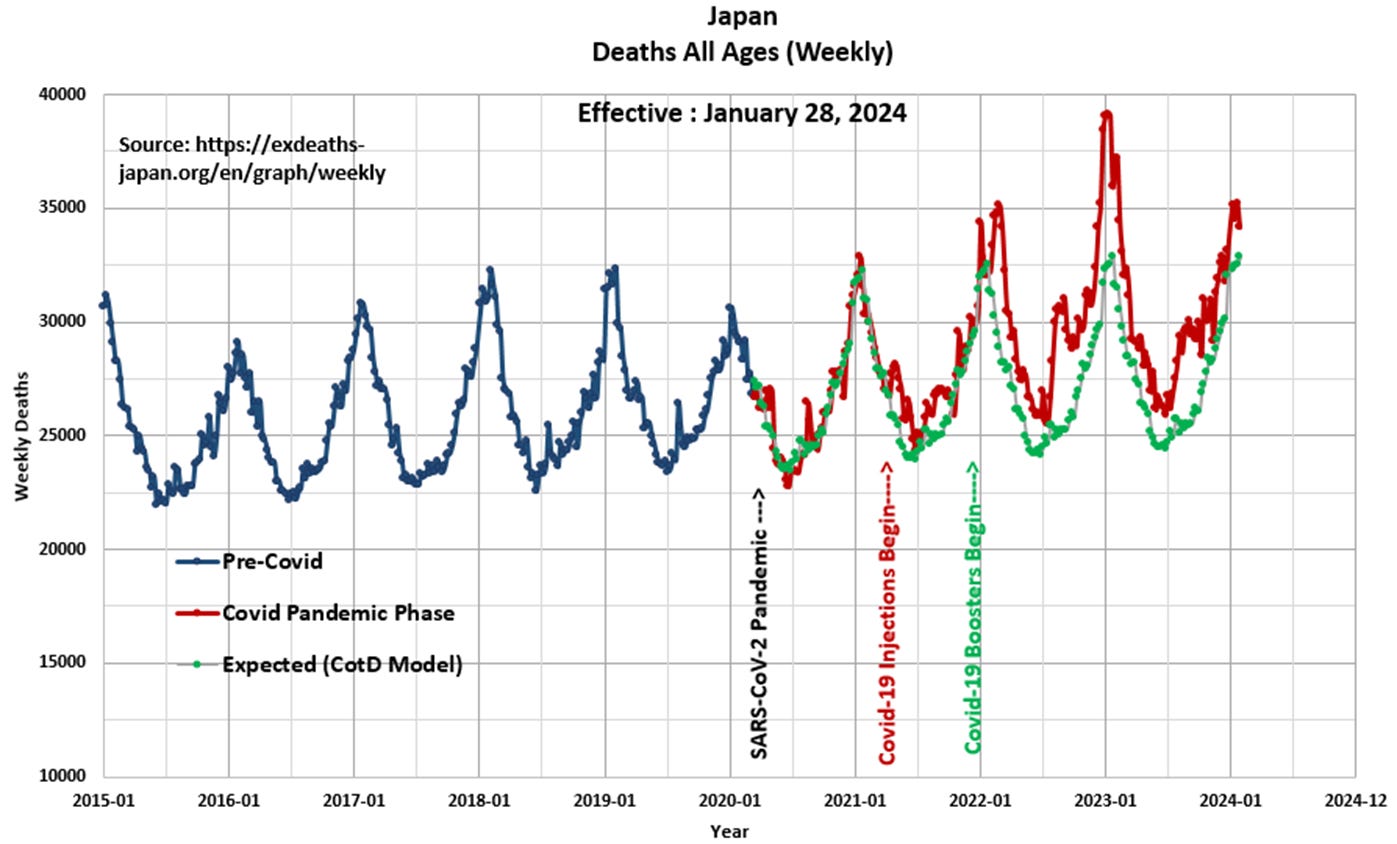

Panel 2 Observe the characteristic cyclical nature of deaths or all-cause mortality since 2015. The “Blue” line represents data prior to March 2020 and the “Red” line represents data since the SARS CoV-2 pandemic was initiated in March 2020. The “Green” line represents the “Expected” deaths (CotD Model) based on historical averages. The author has utilized the Japan data for the five year period January 2015 to December 2019 in order to calculate an average normalized curve for Weekly Deaths. The Expected (CotD Model) deaths incorporates an average 5 percent growth factor which appears to be a good match to the overall trend.

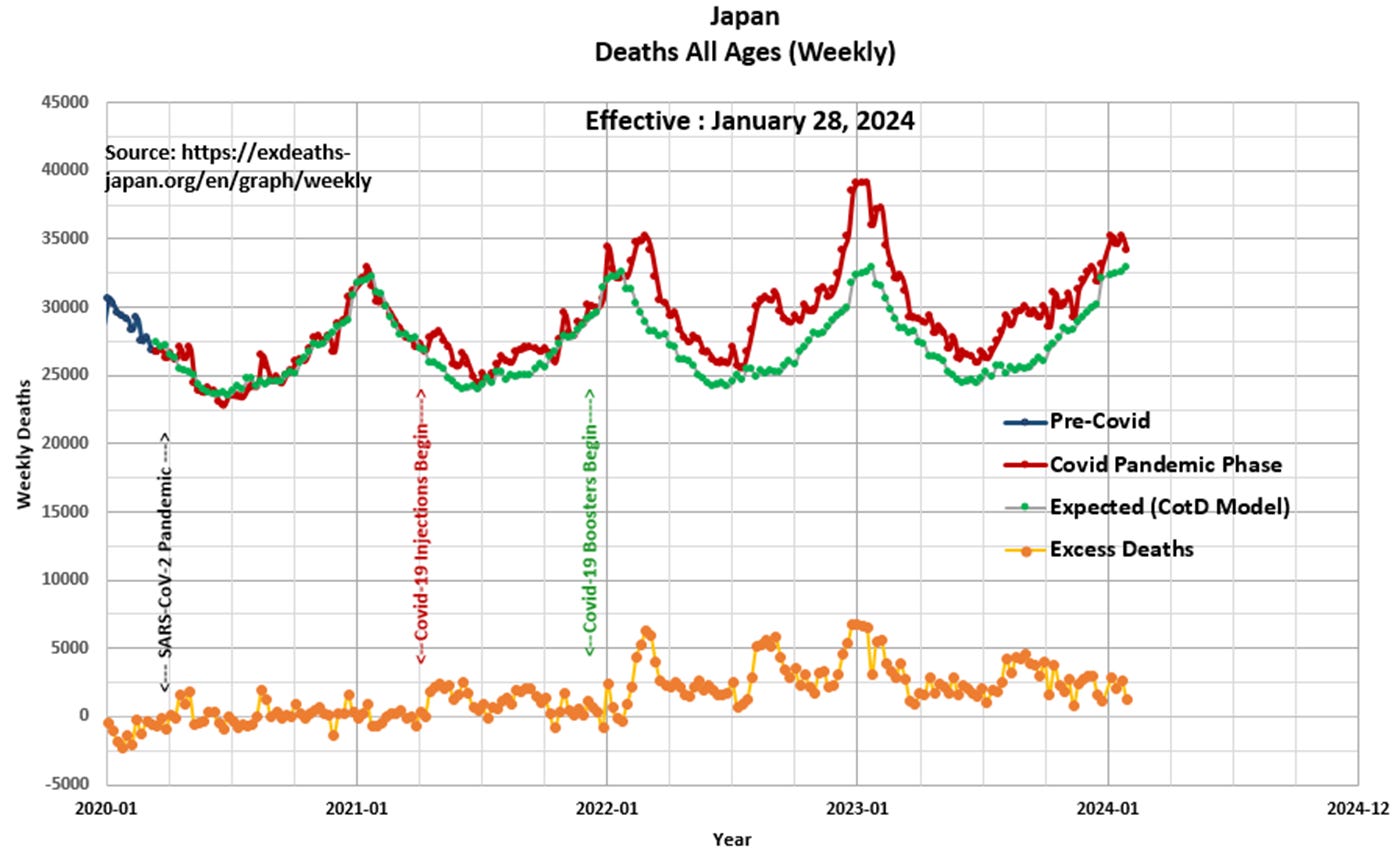

Panel 3 This presents the magnified portion (January 2020 to January 2024) of the graph in Panel 2. The “Orange” line represents “Excess Deaths” which is calculated by subtracting Expected Deaths from Official Deaths.

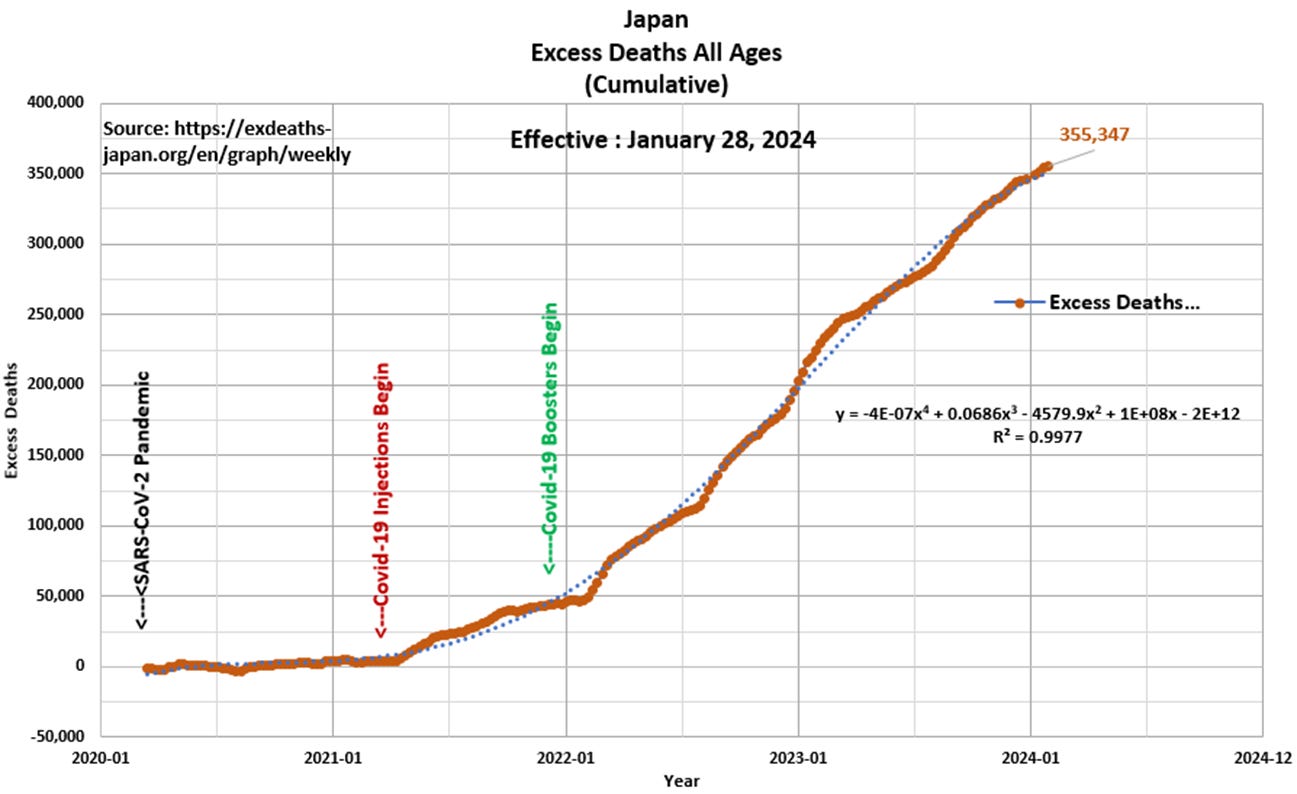

Panel 4 Based on the data and this author’s model, of the 355,347 Excess Deaths since the start of the pandemic, 351,871 Excess Deaths (99 percent) have occurred since the start of Covid-19 injections in March 2021. This compares to 209,871 excess deaths over the same time frame as per the ourworldindata.org website. The bottom line is that both methods of estimating excess deaths point to a very large number which is very concerning and requires a full investigation. Note the blue-dotted curve is a polynomial (non-linear) best-fit to the data up-trend. In essence, this reveals that the Excess Death Rate (EDR) is accelerating with time, which is a strong signal something is abnormal within Japan’s population. Once again, the question is “why is this occurring?

“Perceive that which cannot be seen with the eye” Miyamoto Musashi

The post Chart of the Day (CotD) Japan Covid and Excess Deaths, by Eldric Vero appeared first on Easton Spectator.

Click this link for the original source of this article.

Author: Michael Easton

This content is courtesy of, and owned and copyrighted by, https://www.eastonspectator.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.