Authored by Charles Hugh Smith via Substack,

One of our primary survival traits is the ability to anticipate the future to avoid threats and reap higher yields. We seek a vantage point to view the road ahead, or even better a road map to what’s ahead.

Is there a road map to what’s ahead? An enormous amount of research and projections are issued daily, proposing answers to the question: what happens next?

In my view, a good starting point is to recall that there are critical differences between open systems and closed systems. A clock is a closed system, and so its functions are predictable. An ecosystem is an open system, and so predictions are contingent on an unknowably large number of potential changes in inputs, processes and feedback: new invasive species may arrive and displace native species, predators might be decimated by a new disease, etc.

But even open systems operate according to principles we can discern, and so they are not entirely unpredictable or chaotic. For example, when a keystone species is wiped out, the entire ecosystem collapses.

The immense powers of modern technology, engineering, cheap energy and mass media have created an illusory aura of human agency, that we can control our future in the same way we control machinery. This aura has also created a sense that human leaders or elites control our world with god-like powers of precision. This too is an illusion, as the contingencies, forces, feedbacks and second-order effects of open systems are beyond the control of any human leadership.

Consider the collapse of marriage and birthrates globally; leaders recognize the threat this poses and have tried to reverse the tide, with little effect. Some propose that these dynamics are the result of secret agendas to reduce the human populace, but the causal links required by this theory are not persuasive: people don’t abandon marriage and raising a family lightly, and there are many factors at work: mating, marriage and having children is an open system, and demographics can’t be dialed up or down at will.

So what road maps do we have for inherently unpredictable and not entirely controllable open systems?

One is the cycles of human history, which reflect that our Wetware 1.0 instantiated around 200,000 years ago leads us to respond in a very limited number of ways to threats and windfalls. I’ve often recommended the book Global Crisis: War, Climate Change and Catastrophe in the Seventeenth Century as evidence that the present has many similarities to the 1600s, which was beset by climate change, scarcities, wars and political conflicts.

Another is how leaders and populaces respond economically to scarcities and threats.

Yet another is human psychology, which maps how we respond to scarcities and threats via denial, magical thinking, cognitive biases, etc.

A fourth map is based on cultural and sociological dynamics embedded in communities, tribes and nation-states.

Let’s take a brief look at each of the three, all of which are worthy of entire volumes.

My colleague Gordon Long published this road map of how economic-financial leaders respond to the stagnation of growth: Gordon calls the entwined trajectories Monetary Malpractice and Moral Malady: financial deceptions (low inflation, etc.) lead to distortions which then generate delusions: our economy can grow forever, as there are no limits on our powers.

This path is paralleled by a decline in ethics, as the deceptions and distortions require misinformation as a means to manipulation (securities no longer marked to market, etc.) which leads to malfeasance, mispricing (of risk) and malinvestment.

These two dynamics generate moral hazard (the disconnection of risk and consequence), unintended consequences (system fragility) and dysfunctional markets (bubble economies, etc.) The end state is instability, failure and collapse, as the ethical and factual foundations of economic decision-making have been gutted to protect the status quo.

The irony is striking: to save us from any sacrifice, we undermine the system so it veers into instability and collapse, generating extremes of sacrifice.

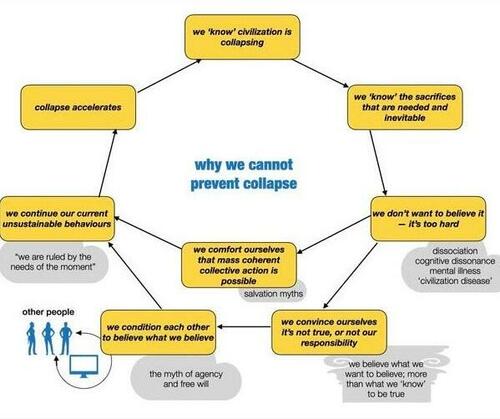

A similar destination appears in this chart of the psychology of collapse: we avoid the pain of sacrifice and convince ourselves that something or other will magically create a secure future without us having to take responsibility or make sacrifices. In the current era, this something is technology: AI will do all the work, etc.

As pressures mount, we focus on short-term needs, because we must do so and also because the shorter term is all we can control. We assure ourselves and others that we can collectively resolve all threats as we’ve done so in the recent past (i.e. recency bias): we’ve got top people working on it, top people.

Since we haven’t changed either inputs or processes, the system careens into collapse.

A 2021 article in Foreign Affairs magazine outlined the sociological factors that guide our collective responses to large-scale threats, crises and challenges: The Threat Reflex: Why Some Societies Respond to Danger Better Than Others (Michele Gelfand)

“The Greek historian Herodotus, in his travels across the world in the fifth century BC, was the first to observe the opposing tendencies of societies toward either order or permissiveness. He singled out the Persian Empire for its openness to foreign ideas and practices: “There is no nation which so readily adopts foreign customs as the Persians. Thus, they have taken the dress of the Medes, considering it superior to their own; and in war they wear the Egyptian breastplate.”

By contrast, he described the Egyptians as having very strong norms, especially about cleanliness, religion, and respect for authority. Two centuries later, the Greek historian Polybius contrasted Roman discipline, order, and rationality with Celtic impetuosity, chaos, and passion on the battlefield. These ancient writers had stumbled on one of the most important ways in which human groups varied—by the strength of their social norms.

It wasn’t until the late 1960s that social science took account of these essential differences. The American anthropologist Pertti Pelto introduced the terms ‘tight’ and ‘loose’ in his work on underlying cultural codes.

A country that closely observes and upholds social norms can be considered to be ‘tight.’ People in those societies don’t tolerate deviance and generally follow the rules. ‘Loose’ countries celebrate individual creativity and freedom. They are lax in maintaining rules and customs but very tolerant of new ideas and ways of being.

Tightness and looseness confer advantages and disadvantages to societies. Tight cultures exemplify order and discipline. Societies with tight cultures tend to consist of individuals who are more attentive to rules, have greater impulse control, and are more concerned about making mistakes. They have higher uniformity–even to the point where their clocks are more synchronized on city streets.

Loose cultures have less order: people have lower impulse control and suffer from greater levels of debt, obesity, alcoholism, and drug abuse. But countries with loose cultures also boast much higher levels of openness: they are more tolerant of people of different races, religions, and sexual orientations; are more entrepreneurial; and have much higher levels of creativity.

But what explains these variations in social norms? Tight cultures and loose ones don’t share any obvious characteristics, such as geography, language, religion, or traditions. GDP isn’t a factor, either: rich and poor countries abound in both categories. Japan, a rich country, and Pakistan, a poor one, have tight cultures; the rich United States has a loose one, as does the far poorer Brazil. Instead, the extent to which societies have been exposed to collective threats in part determines their relative tightness or looseness.

Tight cultures have grappled with more frequent natural disasters, a greater prevalence of disease, greater resource scarcity, higher population density, and territorial invasions. Groups exposed to frequent dangers need stricter rules to coordinate to survive. Groups that have experienced fewer threats can afford to be permissive.

Tightening during times of threat is an important adaptation that helps groups coordinate and survive. Populist authoritarian leaders hijack, amplify, and manipulate threat signals and then promise to return their countries to a tight order. Understanding tight-loose dynamics can help countries better anticipate and manage these challenges.

The sudden displacement of long-standing regimes can unleash extreme disorder that allows populist autocrats to step into the breach and promise to replace chaos with tightness. History repeatedly shows that chaos pushes people toward a yearning for tightness. This psychology leaves populations in places where norms have collapsed vulnerable to extremists.

What I call ‘tight-loose ambidexterity’: the ability to tighten when there is an objective threat and loosen when that threat recedes.”

As we’ve seen, democracies can respond in a highly authoritarian fashion to threats, “tightening” legal, social, financial and political controls. Though the article doesn’t mention this, I discern a feedback loop in this tightening: as events seem to escape this tightening of centralized control, the leadership instinctively increases the tightening, seeking to impose even greater control of the populace and economy.

This tightening eventually crosses thresholds and generates second-order effects: people sense the restrictions are not helping resolve whatever threats exist, they’re adding a new threat to civil liberties, social mobility / agency and economic freedoms, all of which are the foundational dynamics of an open, adaptable society.

Globally, nation-states appear to be exhibiting elements of all four road maps. Few seem to be exhibiting ‘tight-loose ambidexterity’ or a willingness to impose necessary sacrifices first on those most able to make sacrifices, i.e. their elites. This does not bode well in terms of changing inputs and processes consequentially enough to change the trajectory toward instability.

Tyler Durden

Sun, 04/21/2024 – 11:40

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://zerohedge.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.